What is Cascading?

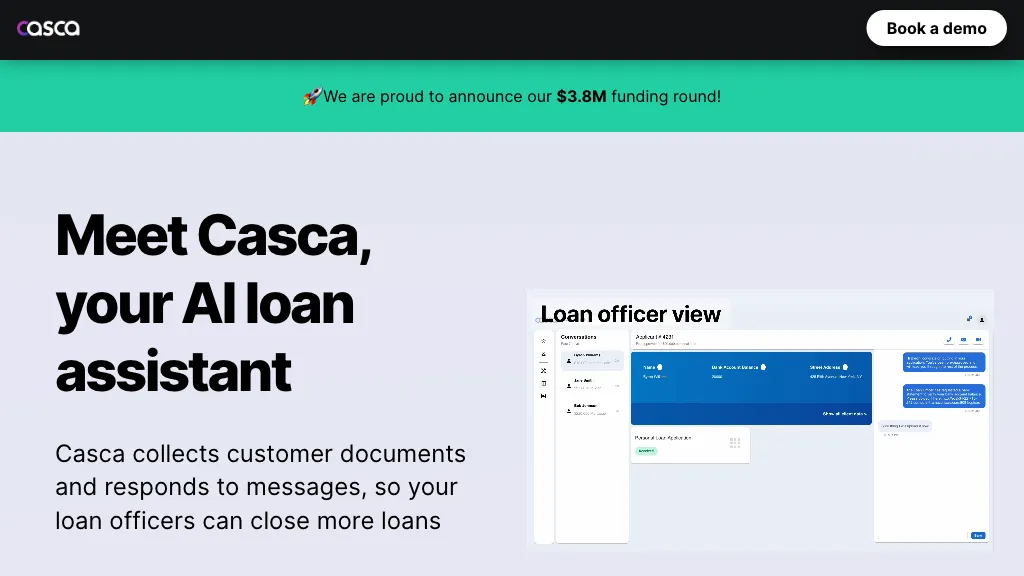

Cascading AI is a game-changing platform which will disrupt the lending process by automating the collection of customer documents and messaging responses, hence freeing up loan officers to close more loans. Built by an all-Stanford team with experience from top-ranked banks and core banking providers, Cascading AI has secured investment from top fintech and AI investors in Silicon Valley. This tool saves a lot of precious time and cost while also enhancing the conversion rate and efficiency of the loan officers.

Key Features & Benefits of Cascading

Cascading AI is embedded with many features that make it extremely valuable for its customers. A few of the key features are as follows:

- Automates the collection of customer documents.

- Responds to messages on behalf of loan officers.

- Liberates a lot of time for each loan officer – approximately 15 hours per week;

- Enables the loan conversion rate to increase.

By automating administrative tasks, Cascading AI frees loan officers from routine manual work. It allows them to concentrate their work on much more valuable aspects of their work, which leads not just to high timesaving and cost reduction but also to higher productivity and better customer experiences since the processes of loan applications will be up to ten times faster.

Use Cases and Applications of Cascading

Cascading AI will find very fine applications in banking and lending services. Here are specific examples of how it can be put into place:

-

Loan Processing Smoothening:

Automation in document collection and response to messages by Cascading brings down the loan processing time by a minimum. -

Loan Officer Productivity:

Since more routine tasks would be automated, this would free the loan officers to undertake more complex and value-added activities. Faster processing times and efficient communication translate to a better experience for loan applicants.

The most value of integrating Cascading AI in operations will be achieved for the loan officers and financial institutions, as this solution directly impacts pain points associated with onerous administrative tasks.

How to Use Cascading

Getting started with the Cascading AI is fairly easy. How? Let’s explore:

-

Get Started:

Create an account on the Cascading AI platform. -

Upload Documents:

Upload the customer documents required into the system. -

Automate Responses:

Set up automatic responses to frequently asked questions and for follow-ups. -

Monitor Progress:

The site dashboards can be used for tracking loan application status quo and saving time.

For Optimal Outcomes: All document templates and communication protocols must be set up correctly, and also automated responses should be reviewed on a timely basis to ensure that they remain current with the most recent regulatory requirements and customer expectations.

How Cascading Works

Cascading AI uses advanced algorithms along with machine learning models that automate the collection and processing of customer documents. A general view of the work process would look something like this:

-

Document Collection:

Scanning and collection of required documents by the AI system from the customers. -

Data Processing:

The collected data is processed in accordance with the standards set. -

Automated Responses:

The system automatically responds to customer queries and does follow-ups, if necessary. -

Application Review:

The loan officers can then go through the processed applications and make their final decisions based on recommendations provided by the AI.

Through natural language processing and machine learning techniques, Cascading AI further develops its efficiency and accuracy for repetitive tasks.

Pros and Cons of Cascading

Being a technological tool, there are several advantages and disadvantages associated with Cascading AI:

Pros:

- A lot of time can be saved by loan officers.

- It is cost-effective, as it reduces the work of manual administration.

- Conversion rates for loan applications will rise.

- The customer experience will be enhanced as the speed of the process increases.

Cons:

- Initial setup and configuration is time-consuming and requires many resources.

- Inability to work properly without dependence on the technology may present problems in case of issues with the system.

Outcomes: From the users’ response, it has emerged that the users are somewhat satisfied with its due to increased efficiency and reduced workload.

Conclusion about Cascading

This is quite an interesting solution for the lending industry, saving a lot of time and money while increasing productivity. Advanced features and automation make it a must-have tool for every loan officer and financial institution. As the platform evolves, one can only expect new features and more enhancements that will truly give Cascading AI a leading position in the world of fintech.

Cascading AI FAQs

What is Cascading AI?

Cascading AI is an automated platform that smoothes the whole lending process by collecting all customer documents and responding to messages in order to enhance the efficiency of loan officers.

Who benefits from Cascading AI?

Loan officers, financial institutions, and any professions dealing in the lending process highly benefit from using Cascading AI.

How does Cascading AI enhance loan processing?

Cascading AI accelerates this by automating routine administrative tasks, freeing up a loan officer’s time to attend to more critical matters at hand and improving the overall customer experience.

What are the key features of Cascading AI?

Automated document intake, auto-responder to messages, saves time for loan officers, and increases conversion rates.

Must one pay for Cascading AI?

There is, of course, a cost to leveraging Cascading AI. Very quickly it pays for itself via saving time and reducing costs. For specific pricing, reach out to Cascading AI.