What is Zynlo Bank?

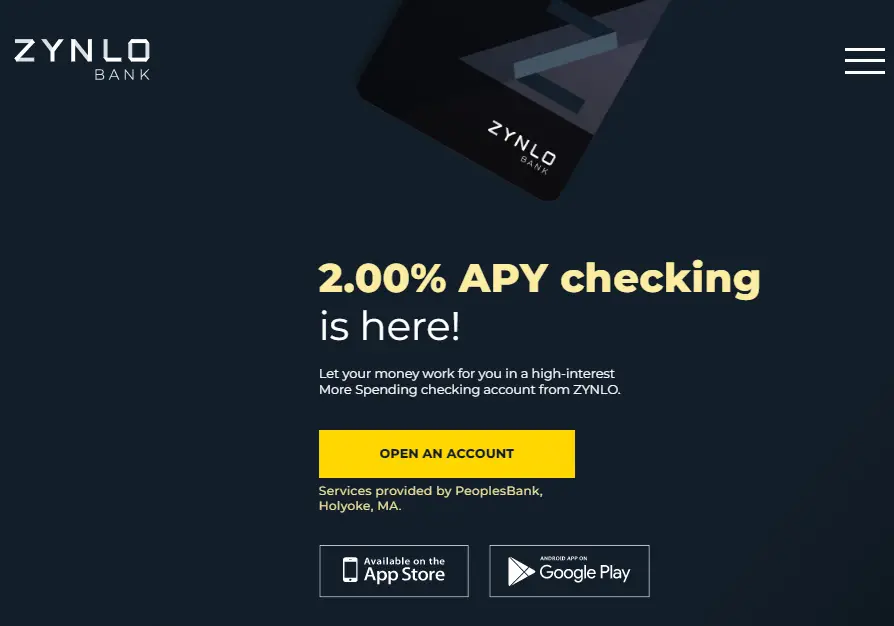

Zynlo Bank is a digital banking service of PeoplesBank. Introduced in the year 2020, it offers its users online facilities for creating an account, using debit cards, and setting different finance-related reminders. Because of its user-friendly interface, it gained mammoth popularity. Apart from all its digital services, more than 55,000 ATMs spread across the country back it so that a user can withdraw cash whenever they need it. Along with these services, it has a 24×7 service helpline number for customer support.

Key Features & Benefits of Zynlo Bank

- Online Accounts: Open a debit card for free.

- Anytime Withdrawal: Over 55,000 surcharge-free ATMs.

- Online Services: Flexible and convenient online banking solutions.

- 24/7 Service: Round-the-clock customer support.

- No Hidden Fees: No maintenance fees or no minimum balance required.

- Automated Payments: Schedule and automate bill payments.

- Remittance and Transfers: Peer-to-peer remittance and fund transfers.

- Multiple Payment Methods: Supports Apple Pay, Google Pay, and more.

- Asset Management: This comprises detailed reports on asset balances, income, and expenditure.

The key benefits associated with Zynlo Bank include no-fee accounts, access to an enormous ATM network, and customer support, which is always available to help clients. These factors make it the most convenient and reliable digital bank.

Use Cases and Applications of Zynlo Bank

Zynlo Bank is versatile and thus applicable in many scenarios:

-

Personal Banking:

Manage your personal finance, pay bills, and also get access to cash using ATMs. -

Business Banking:

Simplify business transactions with the ease of transferring funds and creating financial reports. -

Travel:

Get cash while traveling through a vast network of ATMs.

Zynlo Bank’s seamless processing of payments and management of finances can be an ideal solution for sectors like retail, hospitality, and e-commerce.

How to Use Zynlo Bank

You can get started with Zynlo Bank by the following steps:

- Firstly, go to Zynlo Bank’s website.

- After that, click “Log in” in the upper right corner.

- Type in your username and password and press “Sign-in.”

- If you don’t have an account, then click on “Enroll in Online Banking.”

- Input the last four digits of your Social Security Number, username, and zip code.

- Complete the sign-up process by following the verification instructions provided.

A customer will discover numerous other capabilities only by navigating the website or the mobile app and choosing the feature that they want to use at the time.

How Zynlo Bank Works

Zynlo Bank is completely online in all respects. It employs the highest level of technology in rendering banks’ services via the online mode. Opening accounts, managing finances, making and receiving payments are done through a secure online interface. Its vast network of ATMs and 24/7 customer support strive to offer a smooth experience in banking.

Pros and Cons of Zynlo Bank

Pros

- No fees or hidden charges.

- Vast network of ATMs.

- 24/7 customer support.

- Easy online and mobile access.

- Automatic bill paying and personal finance management tools.

Cons

- Few physical branch locations.

- Require internet access to access most services.

Generally speaking, the vast majority of customer reviews are very positive about Zynlo Bank, adding convenience and rich features.

Conclusion about Zynlo Bank

In summary, Zynlo Bank offers a solid digital banking solution, varied from no-fee accounts to 24/7 customer support. With its vast ATM network and a user-friendly interface, it will be an excellent choice to cater to both personal and business banking needs. As digital banking moves further into the future, so will Zynlo Bank, with even more leading-edge solutions.

Zynlo Bank FAQs

-

Is Zynlo Bank real?

Yes, Zynlo Bank is a legit digital bank developed by PeoplesBank. -

Is Zynlo Bank free?

Yes, using Zynlo Bank is totally free. -

Who is the founder of Zynlo Bank?

Zynlo Bank was developed by PeoplesBank.