What is Top VC Funds?

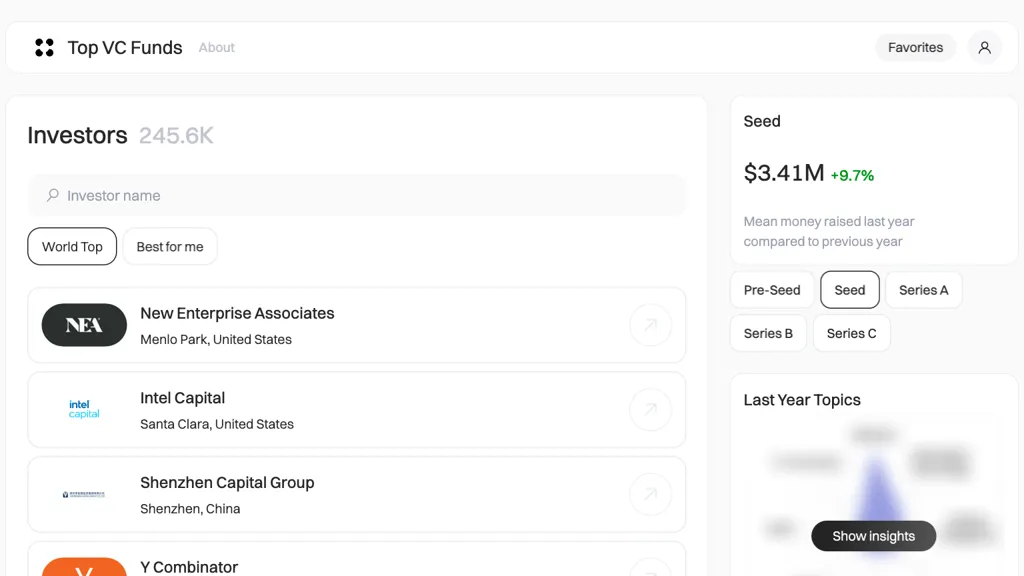

Top VC Funds is an intelligent tool that’s responsible for huge insight and analysis of major venture capital funds from all over the world. This allows a user to follow future investors in comfort, track current competitors with ease, and find favorite investors with ease. It spots top-notch funds such as New Enterprise Associates and Sequoia Capital-including funding round information, raised amounts, and competitive analysis. It acts as a great tool to have in-depth insight into the investment landscape with strategic focus on main markets: the United States, the United Kingdom, and China.

Key Features & Benefits of Top VC Funds

Insights and Analytics: Get a full overview of top venture capital funds with insights to keep the user really up-to-date.

Investor Tracking: It allows seeing the investor of the future, current competitors, and the most popular investors.

Funding Insights: See all funding rounds and cash raised in an easy-to-understand format.

Competitor Analysis: Very important competitor analysis in place.

Geographical Highlights: It pinpoints the most attractive countries for investment purposes.

Top VC Funds provide better decision-making in this highly competitive venture capital ecosystem.

Top Use Cases and Applications of Top VC Funds

Top VC Funds have been deployed in various instances to empower different stakeholders in multiple ways across the venture capital ecosystem for their numerous roles:

Ahead of the Curve: It keeps you updated on what is hot and trending in the world of VC; identifying new groundbreaking investment opportunities via deep analytics and insight.

Fundraising Activity Tracking: Monitor funding rounds and fundraising activity by the leading VC funds such as New Enterprise Associates and Sequoia Capital to keep you updated with the current scenario and learn about the partnership opportunities.

Competitor Analysis: The aim is to identify top-ranked venture capital firms through competitor analysis. This will enable chalk out a better positioning strategy along with market intelligence.

Top VC Funds application would be extended to founder of a startup, venture capitalist, investment banker, business analyst, researcher, entrepreneur, business strategist and private equity professional.