What is Taxly.ai?

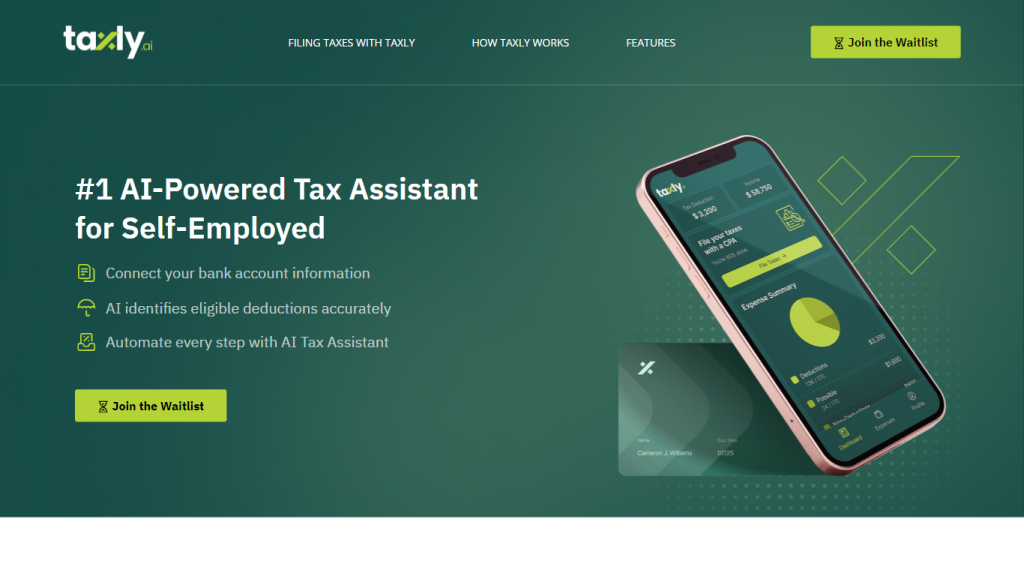

Taxly.ai is an AI-driven, integrated tax assistant custom-built for freelancers and the self-employed, and small businesses, in Australia. It seeks to be a platform that makes filing taxes easier by simplifying the process to be efficient and error-free. The platform automates deductions using AI and makes expense tracking easy and secure, thus providing convenient management for customers of their taxes in real-time.

Key Features & Benefits of Taxly.ai

Hassle-Free Tax Filing:

Make filing taxes hassle-free with AI to ensure accuracy in deductions and efficiency. Seek help from expert CPAs for the smooth management of taxes and grab the opportunity for savings.

Easy-to-Use UI:

Breeze through a user-friendly app designed for the needs of freelancers and the self-employed.

Security for Data Management:

Highly secure bank account information and transactions.

Personalised Tax Reports:

Get personalized tax reports with quarterly tax estimates to help you keep organized and ahead.

Real-time expense tracking:

Track expenses in real time and auto-categorize for accurate deductions based on the ATO’s tax guidelines. In that respect, Taxly.ai is necessary for ensuring maximum deductions that ensure minimized tax liabilities and managed taxes with confidence.

Use Cases and Applications of Taxly.ai

The following use cases can apply to Taxly.ai to benefit different user groups:

-

Automated Tax Filing:

Through Taxly.ai, self-employed and small businesses can connect their bank accounts to the AI. This AI will track deductions one is entitled to for perfect tax management. -

Custom Tax Reports:

Freelancers will have access to custom tax reports and quarterly estimates to stay organized and plan accordingly. -

Track expenses on-the-go:

With our friendly user interface at Taxly.ai. With expert CPA support, you can make more deductions for a more effortless way of doing taxes.

This will be particularly useful for industries like freelancers, self-employed professionals, and small business owners who juggle many different income streams and side gigs.

How to Use Taxly.ai

Getting started with using Taxly.ai is very easy and intuitive. Here’s a brief guide to get you up and running:

-

Signup:

There’s a waitlist open to everyone to keep up with the development and launch of this app. -

Connect Your Bank Account:

This allows one to connect securely with the bank account so as to onboard real-time expense tracking for identification of deductions.

It keeps real-time expense tracking. The AI categorizes them and makes accurate deductions. It consists of expert CPA support to give customized advice and compliance. It features automated tax filing, accuracy, and efficiency in tax management. It ensures that all of the financial data is current and consults a CPA on a regular basis for custom advice.

How Taxly.ai Works

The key force behind Taxly.ai is advanced AI algorithms, making the process of tax filing fully automatic. It would track your living expenses in real time, categorize them, and recognize eligible deductions under ATO Tax by integrating with your bank account. Another workflow of the platform consists of:

-

Data Integration:

Connect securely with your bank to track it in real time. -

AI Analysis:

AI-driven analysis of all transactions for deductions. -

CPA Support:

Expert consultancy for compliance and maximized savings. -

Automated Filing:

Accuracy and efficiency in an automated tax filing process.

Taxly.ai Pros and Cons

Pros

- Automated, accurate tax filing process

- Pros of CPAs to offer customized advice for complex taxes

- Track and categorize expenses in real-time

- Easy-to-use UI designed for freelancers and self-employed individuals

- Robust data security features

Cons

- Only available to users in Australia

- This involves integration with the bank account, which could be seen as an issue among users of high regard for their privacy.

All in all, user reviews generally speak of ease of use and efficiencies with AI-based features. Of those, the feature in personalized support to achieve a CPA has been highly lauded.

Conclusion about Taxly.ai

Taxly.ai is the all-in-one package for any freelancer or self-employed people with respect to taxation in Australia. It empowers users with managing their taxes efficiently and very accurately through AI-driven features, expertly supported by qualified CPAs. Tight security features and a user-friendly interface make Taxly.ai an application sure to revolutionize how users handle their taxes. Further developments involve expansion into other regions and even more advanced features.

Taxly.ai FAQs

What is Taxly.ai?

Taxly.ai is a super-intelligent AI-driven tax app designed explicitly for people, freelancers, and the self-employed in Australia to make filing taxes hassle-free with AI-automated estimations.

Can I track multiple sources of income on Taxly.ai?

Yes, Taxly.ai is fully equipped for those who have multi-stream income and side gigs, freelancers, and gig workers.

Is my financial information safe on Taxly.ai?

Be assured that it will be protected by rigorous encryption and tight privacy inside Taxly.ai.

Does Taxly.ai offer real-time expense tracking?

Yes, Taxly.ai has real-time expense tracking, featuring automated expense categorization for accurate deductions per the ATO Tax guidelines.

Will I get personalized tax advice on the app?

Yes, Taxly.ai offers expert consultation with a CPA in Australia for personalized tax advice and compliance.