What is Swipe?

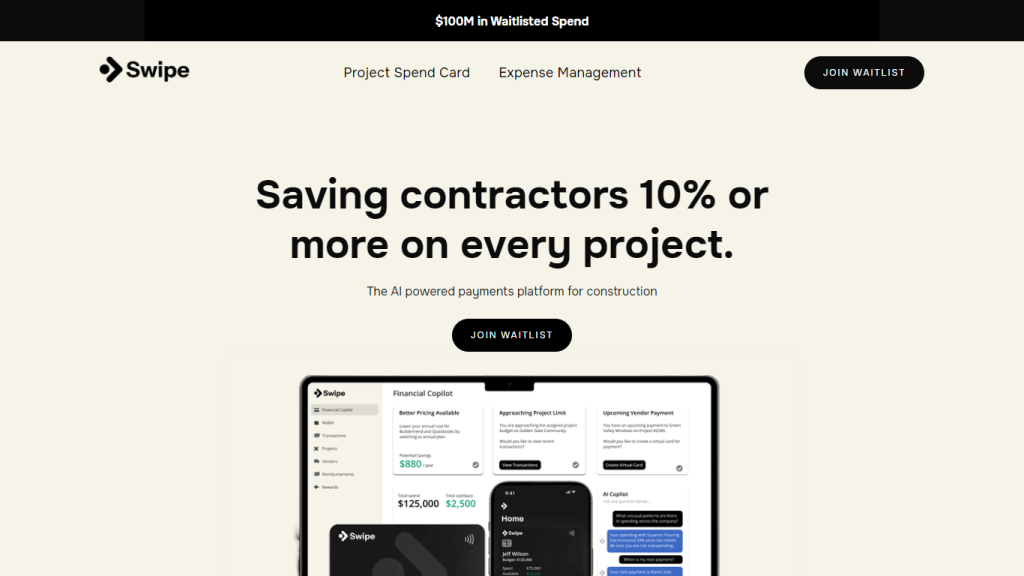

Swipe is an innovative spend platform powered by artificial intelligence, specifically designed to optimize financial operations for construction projects. By merging project management tools with advanced expense tracking capabilities, Swipe significantly boosts efficiency for users. The platform encompasses various features, from managing supplier payments and vendors to automating accounting processes, all aimed at streamlining construction project management.

Swipe’s Key Features & Benefits

Swipe offers a plethora of features tailored to meet the unique needs of the construction industry:

- AI Empowerment: Integrates project management with AI-powered expense tracking for enhanced operational efficiency.

- Cost Savings: Projects utilizing Swipe can expect an average cost reduction of 10%, thanks to robust expense management controls.

- Time Efficiency: Automated receipt collection and mobile capture technology save approximately 60 hours per project.

- Reward System: Users can earn 1% cash back and gain access to vendor discounts through Swipe Rewards.

- Project Budget Control: Allows for pre-set budget limits on projects and employee cards with transaction matching to project plans.

These features not only enhance efficiency but also provide substantial financial benefits, including vendor discounts and cash back incentives.

Swipe’s Use Cases and Applications

Swipe is particularly beneficial in various scenarios within the construction industry. Here are some specific use cases:

- Expense Tracking: Contractors can streamline expense reporting and management, reducing manual labor and errors.

- Vendor Management: Facilitates seamless vendor payments and relationships, encouraging faster payment processing for discounts.

- Budget Management: Assigns and monitors project-specific budgets, ensuring financial discipline and control.

- Fraud Detection: AI-driven components help detect and prevent fraudulent activities, safeguarding company finances.

Industries such as construction, real estate development, and infrastructure projects stand to benefit significantly from implementing Swipe.

How to Use Swipe

Getting started with Swipe is straightforward. Here’s a step-by-step guide:

- Sign Up: Register for a Swipe account on their official website.

- Integration: Integrate Swipe with your existing project management and accounting software.

- Set Budgets: Assign budgets to specific projects and employee cards.

- Automate Processes: Utilize automated workflows for invoice verification, expense tracking, and receipt collection.

- Monitor Insights: Leverage real-time insights and AI-powered analytics for better financial decision-making.

For the best results, make sure to regularly review the analytics provided by the AI Financial Copilot and adjust your strategies accordingly.

How Swipe Works

Swipe harnesses the power of AI to deliver a seamless financial management experience. Here’s a technical overview:

- AI Algorithms: Uses advanced algorithms for real-time insights, fraud detection, and financial forecasting.

- Automated Workflows: Automates tasks such as invoice verification, tax compliance, and expense tracking.

- AI Financial Copilot: Provides intelligent payment scheduling and analytics via text messaging.

The platform is designed to scale with your business, ensuring that as your company grows, Swipe’s capabilities expand accordingly.

Swipe Pros and Cons

Like any tool, Swipe has its advantages and potential drawbacks:

Pros

- Significant cost savings with an average of 10% per project.

- Time efficiency through automated processes.

- AI-driven insights and analytics for better decision-making.

- Reward systems offering cash back and vendor discounts.

Cons

- May require initial setup time and integration with existing systems.

- Some users might find the AI features complex to navigate initially.

Overall, user feedback indicates high satisfaction with the platform’s functionality and benefits.

Swipe Pricing

Swipe offers a freemium model, allowing users to access basic features at no cost. For more advanced features and capabilities, various pricing plans are available. This tiered pricing structure ensures that businesses of all sizes can find a suitable plan that fits their budget.

Compared to competitors, Swipe provides excellent value for money, especially considering the array of AI-driven features and potential cost savings.

Conclusion about Swipe

In summary, Swipe is a game-changer for financial management in the construction industry. Its AI-powered features, cost-saving benefits, and time efficiency make it an invaluable tool for contractors. As the platform continues to evolve, users can expect even more advanced features and improvements, further solidifying Swipe’s position as a leader in construction project financial management.

Swipe FAQs

How does Swipe help contractors save money?

Swipe helps contractors save an average of 10% on each project by streamlining expense tracking and offering discounts and rewards.

What are some of Swipe’s time-saving features?

Swipe offers automated workflows, like invoice verification and expense tracking, along with AI-powered analytics & forecasting for project expenses.

Can Swipe manage budgets specific to different projects?

Yes, Swipe allows project-specific budget assignments with pre-set limits for employee cards and matches transactions to project plans.

What kind of AI features does Swipe offer for construction projects?

Swipe provides real-time insights, fraud detection, tax compliance, and AI-driven financial forecasting.

How does Swipe integrate with other systems to manage project spend?

Swipe is equipped with best-in-class integrations that allow users to control spend before it occurs, ensuring financial efficiency.