What is Stripe Capital?

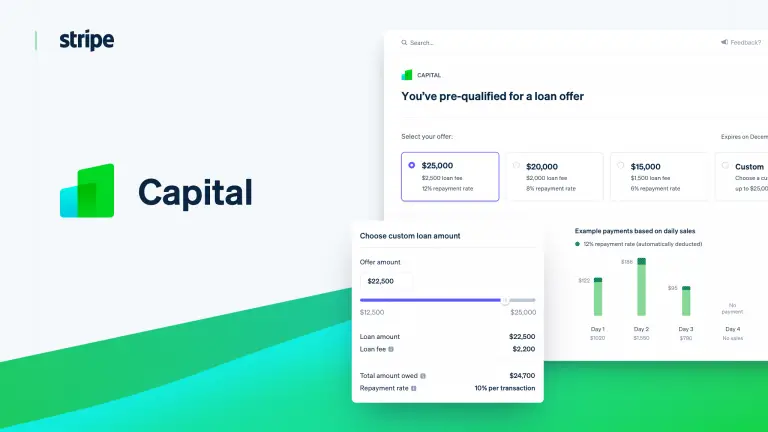

Stripe Capital, launched by Stripe on September 5, 2019, is a loan service platform. Its aim is to provide quick and flexible financial services for the businesses—in particular, SMEs that are in desperate need of funds for business development. There is no need to check credit or undertake any complicated application process. Stripe Capital offers an end-to-end Loan API that offers flexible access to dynamic business loan conditions. Apart from this, automatic loan repayment is also supported where it deducts corresponding funds regarding users’ sales.

Stripe Capital: Key Features & Benefits

Features

-

Quick Application:

Users can easily get funds with no personal credit checks and complicated applications. -

Fast Fund Arrival:

In case of an approved application, usually, the required funds get credited to the user’s Stripe account on the next working day. -

Fixed Fee:

Users pay a one-time fixed fee with no regular fees or mortgage obligations. -

Automation of Repayment:

Repayments are automated and taken out from sales, adjusting for the amount according to revenue earned by the user.

Benefits

Stripe Capital has a few advantages, including a slick application process with quick access to funds and automated repayments, keeping the burden off business owners. These things make it a great option for SMEs to gain funds without experiencing any red tape of regular loan procedures.

Stripe Capital Use Cases and Applications

Stripe Capital can be utilized differently to accommodate a variety of needs for business development. Here are some specific use cases:

-

Working Capital:

This would be used by the businesses to cover the operational cost during day-to-day operations. -

Inventory Purchase:

The retailers would restock inventory with the help of such funds, especially during peak seasons. -

Marketing and Expansion:

Quick loans issued through Stripe Capital enable the SMEs to invest in marketing campaigns or expand their business.

The main beneficiaries of this flexibility that Stripe Capital offers to businesses are in retail, e-commerce, and service industries. Success stories are often repeated regarding how timely financial support enabled a firm to grasp the opportunities of growth or allowed them to efficiently manage cash flow.

How to use Stripe Capital

Step-by-Step Guide

- Go to the Stripe Capital website.

- Click “Log in” at the top right.

- Enter your e-mail and password for your Stripe Capital account. Click “Continue”.

- If you have not registered yet, click “Sign up” and fill in your email, region, and password.

- Once signed in, you will be allowed to go into your account settings, balance, related products, apply for funds, and use other functionalities provided for you.

Tips and Best Practices

- Keep abreast of your sales and repayment progress regularly for better financial management.

- Use the funds judiciously to achieve maximum growth and return on investment in your business.

- Keep the lines of communication flowing for any questions or assistance with Stripe Capital support.

How Stripe Capital Works

Stripe Capital makes use of deep algorithms in calculating the performance of any business and granting it suitable loan conditions. With easy integrations into Stripe’s processing of payments, real-time analytics of sales data would, therefore, be possible. Such a data-driven approach ensures that Stripe Capital extends customized loan terms and automatically structures repayments per performance of sales.

Stripe Capital Pros and Cons

Pros

- Easy, seamless application process without credit checks.

- Access to funds very fast.

- Automated repayments per sales performance.

- Fixed fee system; no hidden charges.

Cons

- Variable pricing may be hard to predict.

- Reliance on the success of the sale to repay can not fit each business model.

User Feedback

Generally, users like the ease and efficiency of Stripe Capital. For instance, Andrew said that the application process is simple and swift, and Benson and Cherry each appreciated how effective the platform was in terms of using it within their business contexts.

How Much Does Stripe Capital Cost?

Pricing is not standardized and is based on the volume of transactions or other business specifics. The following plans are available:

| Plan | Price | Features |

|---|---|---|

| Pay-as-you-go | 2.9% | Everything you need to manage payments |

| Custom | Contact sales | Get hundreds of feature updates each year, volume discounts, multi-product discounts, interchange pricing, and country-specific rates |

For those businesses that have a larger volume of transactions, contacting Stripe Capital support might bring further discounts and individual pricing.

Conclusion about Stripe Capital

The strong solution provided by Stripe Capital is for fast and flexible financing, therefore eliminating the pain various SMEs go through in conventional loan procedures. This makes it all the more attractive with features such as automated repayment, quick fund disbursement, and fixed fee structure. However, would-be users should be wary of the variability in pricing, as also the repayments pegged on sales performance. In all, Stripe Capital is an effective, workable tool that genuinely serves to extend business enterprise, and it only stands to become even more helpful in future iterations.

Stripe Capital FAQs

What are Stripe Capital alternatives?

Other lending services and platforms that compete with Stripe Capital include Siftery, Bonsai, and Unstack.

Does Stripe do a credit check?

No, Stripe Capital does not check credit. The platform invests all efforts in giving businesses fast, flexible lending.