What is Qashboard?

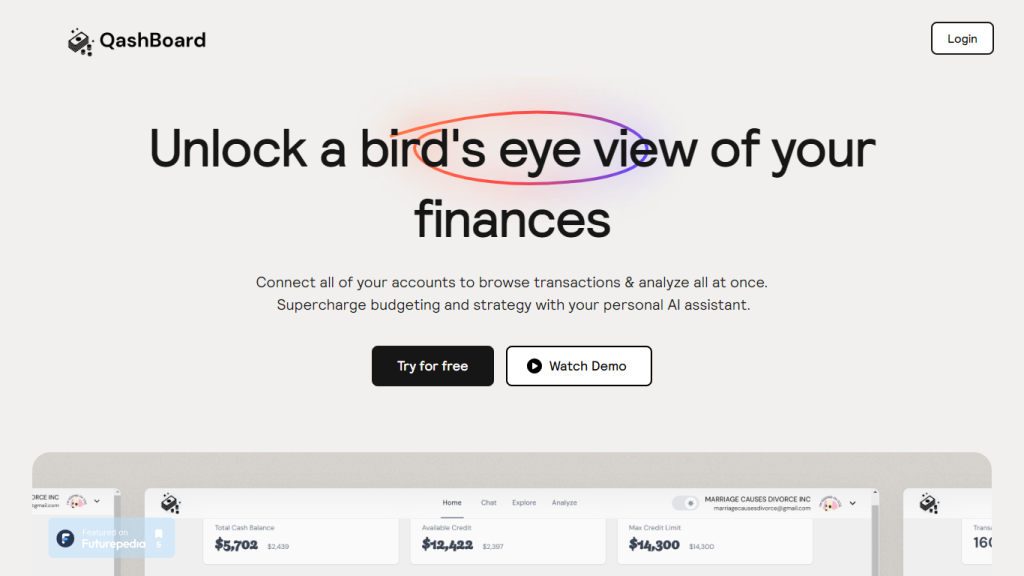

Qashboard is an all-encompassing financial management platform that provides users with a comprehensive view of their financial health by linking various accounts and analyzing transactions. The intuitive dashboard allows for the organization and security of financial data from multiple sources, including debit, brokerage, investment, and credit card transactions.

Qashboard tracks recurring transactions, identifies trends, and delivers actionable insights via a conversational AI interface. The tool also prioritizes data privacy, giving users full control over their data storage.

Qashboard’s Key Features & Benefits

- Financial data analysis

- Automated transaction tracking

- Conversational AI interface

- Secure data storage control

- Finance-related Q&A feature

Qashboard stands out due to its comprehensive financial overview, actionable insights, and stringent data privacy controls. Users can connect their accounts using Plaid to visualize their financial health through detailed charts and explorers. The AskWallet feature, a finance-focused ChatGPT, offers interactive Q&A sessions to provide actionable advice.

By allowing users to bring their own database (MongoDB Atlas), Qashboard ensures zero data visibility for complete peace of mind. Additionally, it includes access to Relume Webflow Libraries, which are valuable for designers needing to store, share, and manage Webflow components.

Qashboard’s Use Cases and Applications

Qashboard automates the analysis and categorization of financial transactions, saving users significant time and effort in tracking expenses and income across multiple accounts. The tool provides personalized financial insights and recommendations based on spending patterns, aiding in making informed decisions for budgeting and saving goals.

Utilize the AskWallet feature to receive instant answers to finance-related queries, offering quick clarification and guidance on various financial matters. Qashboard is beneficial for a diverse range of users including finance managers, business owners, freelancers, and individuals seeking secure finance tracking.

How to Use Qashboard

To get started with Qashboard, users need to connect their financial accounts through the platform, which integrates seamlessly with Plaid. Once connected, the dashboard will display a comprehensive view of all transactions and financial data. Users can then categorize transactions, track spending, and set up budget goals.

The conversational AI interface allows users to ask specific finance-related questions and receive actionable insights. For best results, users should regularly update their data and review the insights provided by the platform. Navigation through the user interface is intuitive, with clear sections for different financial metrics and tools.

How Qashboard Works

Qashboard operates by integrating with users’ financial accounts through Plaid, allowing the platform to pull in transaction data securely. The tool uses advanced algorithms to analyze this data, identifying patterns and trends that can provide valuable insights.

The AI-powered AskWallet feature uses natural language processing to understand user queries and provide relevant answers. The underlying technology combines data retrieval and augmented generation to offer clear and actionable financial guidance.

Qashboard Pros and Cons

Advantages of using Qashboard include its comprehensive financial overview, automated transaction tracking, and robust data privacy controls. Users benefit from personalized financial insights and an interactive AI interface.

However, potential drawbacks include the reliance on user-provided data, which may require manual updates for accuracy. Additionally, while the AI assistant provides financial guidance, it should not be considered a substitute for professional advice.

User feedback generally highlights the platform’s ease of use, insightful analytics, and strong privacy features. Some users, however, wish for more advanced financial planning tools.

Qashboard Pricing

Qashboard offers various pricing plans to cater to different needs. Options include monthly, lifetime, developer, and free plans, each with its own set of features and perks such as community access and Figma kits. The freemium model allows users to explore the platform before committing to a paid plan.

Compared to competitors like Mint or Truebill, Qashboard’s unique no-task-execution policy and data privacy controls offer distinct advantages. The value for money is evident in the comprehensive features and personalized insights provided.

Conclusion about Qashboard

Qashboard is a powerful financial management tool that offers a broad range of features to help users track and analyze their finances. Its unique selling points include a comprehensive financial overview, conversational AI interface, and stringent data privacy controls. While it has some limitations, such as the need for manual data updates, its overall benefits make it a valuable tool for individuals and businesses alike.

Future developments may include enhanced financial planning tools and further integration capabilities. Overall, Qashboard is highly recommended for those seeking a secure and insightful financial management solution.

Qashboard FAQs

- Can I cancel my subscription?

- You can cancel your subscription from your profile page. While you may lose access to the dashboard, any data in your store will remain.

- Why use Qashboard?

- Qashboard enables viewing all financial data in one place and uses retrieval augmented generation for tangible insights.

- Does it give financial advice?

- Qashboard’s AI assistant provides financial guidance, but it should be considered as a summary rather than serious, regulated advice.

- How does support work?

- Support is provided through Slack where you can share a problem and get a walkthrough of a solution from an expert.

- How is it different from Mint or Truebill?

- With its unique no-task-execution policy, Qashboard provides the means to review and act on historical or derived data rather than managing tasks on your behalf.