What is NeonFin?

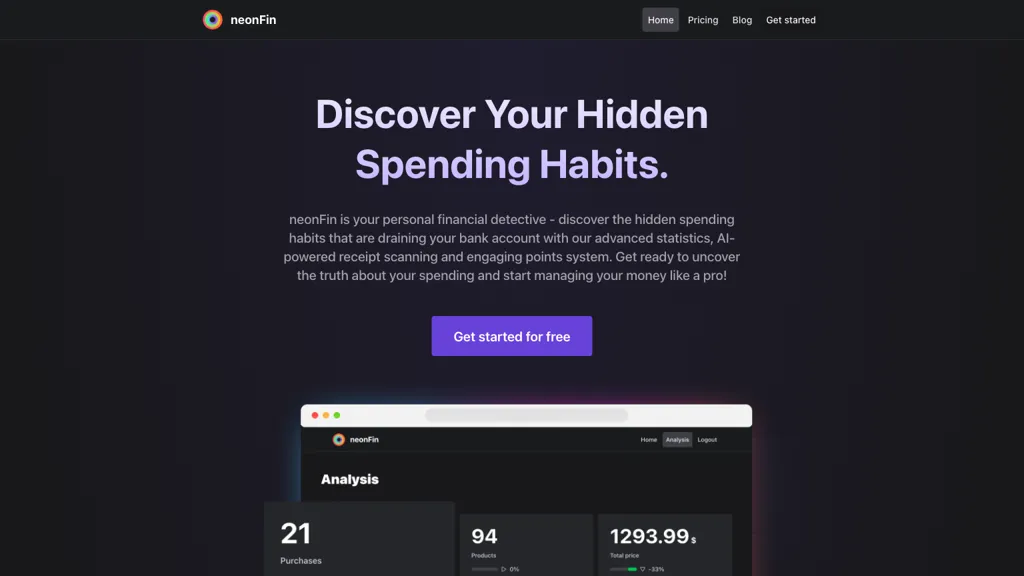

NeonFin is an advanced, AI-driven personal financial detective tool built to help users uncover secretive spending habits that may be stealing from them in their bank accounts. NeonFin allows a user to do professional financial management in-depth, using advanced state-of-the-art statistics and AI-powered receipt scanning to deeply understand spending behavior.

Since the inception of NeonFin, the company developed an intuitive way to make financial management accessible and fun. NeonFin was built around a gamified budgeting system, combined with AI-driven receipt barcode scanning that removes the pain of manual data entry and makes tracking new purchases easier.

Key Features & Benefits of NeonFin

AI-powered Receipt Scanning: Automatic scanning and categorization-eliminating any need for manual input.

Engaging Points System: Gamifies budgeting to make saving money fun and motivating.

Real-time insights: Receive advanced analytics to trace your spending habits and see where you have room for improvement. Create a lifestyle budget: Create your own custom budgets that only relate to your lifestyle.

CO2 emissions tracking: Quantify your carbon footprint right along your financial expenditures.

NeonFin stands unique with a combination of features that somehow help the user save and pursue spending money in an environmentally sound way. Equipped with real-time financial insights and competitive features against friends, NeonFin keeps financial management activities engaging and effectual.

Use Cases and Applications of NeonFin

NeonFin is versatile, serving a variety of user needs and applications:

- Hidden pattern identification of spending: Analyze receipts scanned by NeonFin’s AI for areas where costs can be cut and savings maximized.

- Track expenses by category to make informed decisions regarding budget allocations.

- Gamify budgeting-engage with NeonFin’s points system and be encouraged, save more, and even compete with friends.

NeonFin is primarily an application meant for personal finance management, understanding spending habits, and using interactive and AI-driven tools to analyze finances.

How to Use NeonFin

Getting started with NeonFin couldn’t be easier:

- SignUp: Just create an account on NeonFin’s platform.

- Scan receipts: Upload your receipts using AI-powered barcode scanning.

- Monitor spending: Real-time analytics allow you to track where money is spent, by category.

- Budget your lifestyles, and track to achieve your financial goals.

- Gamify this: Turn it into a game, win points, and outscore friends to stay motivated.

To maximize the potential of NeonFin, make it a regular activity to scan your receipts and check its insights to decide upon and choose your course of action regarding your finances.

NeonFin’s AI and Stats Work

Advanced AI and statistics based on the user data check the following:

- Receipt Scanning: AI-supported tool does all work, starting from receipt scanning to categorizing and detailing expense tracking, without any user inputs.

- Data Analysis: Real-time analytics are provided to study spending behavior and aid in finding ways of improving finances.

- Gamification: The points system ensures that users are enthusiastic about sticking to their budgets and financial goals.

This workflow, from scanning receipts right to data analysis, is so smooth and keeps everything within one system in a comprehensive manner.

Pros and Cons of NeonFin

While NeonFin has a number of advantages, there are some limitations also present which are as follows:

Pros:

- Automated receipt scanning saves time and eliminates manual errors.

- Real-time insights allow for actionable financial information.

- The budgeting process is fun and motivating with gamification.

- CO2 emissions are tracked, promoting green budgeting.

Cons:

- Many tools are somewhat limited when using a free plan.

- May need frequent receipts for input to remain accurate.

Feedback generally cites how easy and effective the tool is to use, but some users also mention it’s unsurprising that free versions of tools come with limitations.

NeonFin is Freemium-priced, hence affordable to individuals of every walk of life, including:

- Free plan: $0/month – Basic features, but limited

- NeonFin Plus plan: $4.99/month – Full features, hence feature-rich financial management

With this pricing, users can get started with the free version of NeonFin and upgrade at any given time when the need arises.

Conclusion about NeonFin

NeonFin is a strong finance management tool, which utilizes AI to make dealing with finance smoother in your life. Its feature blend lets users discover nonevident spending behaviors and better manage their finances in real time. With its gamified system of budgeting, AI receipt scan, and real-time analytics, this app is surely the answer to making people in charge of their finances.

Because NeonFin offers a flexible pricing model and delivers combined attention to financial and ecological responsibility, it is bound to be of an enriched extent to become a priceless facility for users in their efforts to improve their financial condition. Future updates will likely further expand its functionality and further increase the value it provides to its customers.

NeonFin FAQs

-

How secure is my data with NeonFin?

NeonFin uses GDPR-compliant servers in the EU to make sure that your data is secure and private. -

Is NeonFin available for mobile devices?

Yes, NeonFin is available for both computers and mobile devices, so you will be capable of managing your money or your finances from everywhere. -

What if I surpass the boundaries of the free plan?

Upgrade to the NeonFin Plus plan, costing $4.99 per month, in order to access all of the features. -

How often should I scan my receipts?

To gather the most accurate insights, it is best to regularly scan your receipts and view NeonFin analytics. -

Does NeonFin track non-financial data?

Yes, NeonFin is there to track CO2 emissions too; you can keep track of your environmental impact as effectively as you do with your financial expenditure.