What is Mesha?

Mesha is a comprehensive AI-driven bookkeeping and tax solution tailored for businesses of all sizes. Powered by real human bookkeepers and CPAs, it ensures accurate monthly financial statements, tax filings, and legal contract reviews. With Mesha, businesses can access a dedicated team of expert professionals, including skilled tax advisors and seasoned bookkeeping specialists, to keep their financial records up to date and compliant.

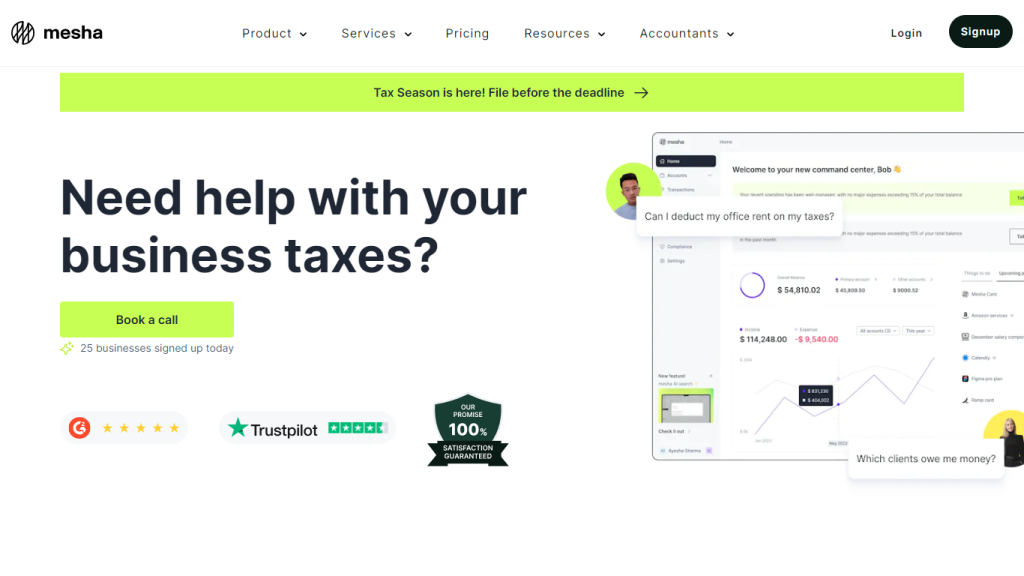

This platform offers tailored insights with real-time profit reports, P&L statements, balance sheets, and cash flow management, all accessible on a centralized financial dashboard. Additionally, Mesha provides a full range of tax solutions, from payroll and income tax to franchise tax and 1099 filings, with certified tax advisors and CPAs on standby to maximize tax deductions and meet all deadlines.

Seamless integrations with popular accounting and finance apps simplify financial processes, offering peace of mind and expert guidance for efficient business growth.

Mesha’s Key Features & Benefits

- AI-driven bookkeeping and tax solution

- Powered by real human bookkeepers and CPAs

- Accurate monthly financial statements and tax filings

- Tailored insights with real-time financial reports

- Full range of tax solutions with certified tax advisors and CPAs

- All-In-One Dashboard: Centralizes financial tasks in one place for better oversight and control

- Bank and Credit Card Integration: Effortlessly connect and sync financial accounts for real-time monitoring

- Auto-Categorized Transactions: Automatic transaction categorization simplifies bookkeeping

- Multi Entity Management: Manage multiple businesses or divisions within a single platform

By using Mesha, businesses can streamline financial management, ensuring accuracy and efficiency. The combination of AI technology and human expertise provides a unique and powerful solution for bookkeeping and tax needs.

Mesha’s Use Cases and Applications

Mesha can be used in various ways to automate and simplify financial tasks. Here are some specific examples:

- Automate monthly financial statement preparation and tax filings using real human bookkeepers and CPAs for accurate financial records and compliance maintenance.

- Access tailored insights and real-time profit reports through Mesha’s centralized financial dashboard, enabling informed decisions for efficient financial management.

- Maximize tax deductions and meet all tax deadlines with Mesha’s certified tax advisors and CPAs, ensuring comprehensive tax solutions including payroll, income tax, and 1099 filings.

Industries that can benefit from Mesha include small business owners, self-employed individuals, freelancers, and startups. These user groups can leverage Mesha to streamline their financial processes, ensuring compliance and efficiency.

How to Use Mesha

Using Mesha is straightforward and user-friendly. Here is a step-by-step guide on how to get started:

- Sign up on the Mesha website to access the platform and start your free trial.

- Connect your bank and credit card accounts to synchronize financial data in real-time.

- Utilize the all-in-one dashboard to manage your financial tasks, including bookkeeping, tax filings, and payroll processes.

- Take advantage of the auto-categorized transactions to simplify bookkeeping and gain clear insights into your financial status.

- Consult with certified tax advisors and CPAs provided by Mesha for tailored tax solutions and to maximize deductions.

For best practices, regularly review your financial reports and insights provided by Mesha to make informed decisions. Utilize the seamless integration with other accounting and finance apps to further streamline your processes.

How Mesha Works

Mesha operates through a combination of advanced AI technology and human expertise. The platform employs sophisticated algorithms to automate bookkeeping and financial reporting tasks. Here’s a technical overview of how Mesha functions:

- AI algorithms categorize transactions automatically, reducing manual data entry and minimizing errors.

- The system generates real-time financial reports, providing insights into profit and loss, balance sheets, and cash flow.

- Human bookkeepers and CPAs review financial statements and tax filings to ensure accuracy and compliance.

- Mesha’s centralized dashboard offers a unified view of all financial activities, enabling efficient management and decision-making.

Mesha Pros and Cons

Here are some of the advantages and potential drawbacks of using Mesha:

Pros

- Combines AI technology with human expertise for accurate financial management.

- Provides a comprehensive range of bookkeeping and tax solutions.

- Offers real-time financial insights and tailored reports.

- Seamless integration with bank accounts and other financial apps.

- Multi-entity management capabilities.

Cons

- May not provide legal or tax representation, limiting its advisory scope.

- Potential learning curve for new users unfamiliar with AI-driven financial platforms.

User feedback indicates that Mesha is highly valued for its efficiency and comprehensive features, though some users may find the platform’s complexity challenging initially.

Mesha Pricing

Mesha offers a freemium pricing model, allowing users to access basic features for free and upgrade to premium plans for more advanced functionalities. This pricing structure provides flexibility and value for money, especially when compared to competitors like Xero and QuickBooks.

Conclusion about Mesha

In summary, Mesha is a powerful AI-driven bookkeeping and tax solution that combines advanced technology with human expertise to deliver accurate financial management. Its comprehensive features, including real-time insights, seamless integrations, and multi-entity management, make it a valuable tool for businesses of all sizes.

For those looking to streamline their financial processes and ensure compliance, Mesha offers a reliable and efficient solution. Future developments and updates are expected to further enhance its capabilities, making it an even more indispensable tool for modern businesses.

Mesha FAQs

What is Mesha?

Mesha is a financial platform that helps with managing finance, taxes, accounting, bookkeeping, and payroll.

Does Mesha integrate with bank and credit card accounts?

Yes, Mesha integrates with bank and credit card accounts for real-time financial data synchronization.

What features does Mesha provide?

Mesha offers an all-in-one dashboard, AI search, invoicing, reporting, automatic transaction categorization, and simplifies tax filings.

How do I get a free trial of Mesha?

You can get a free trial of Mesha by signing up on their website.

Is Mesha a legal or tax advisory firm?

Mesha is not a law firm and does not provide legal or tax representation; it is intended for informational purposes only.

“`