What is Kniru: AI-Powered Finance?

Kniru AI-Powered Finance is your ultimate financial companion, offering hyper-personalized financial management, addressing the particular needs of each individual. In addition, with Kniru, users will acquire precise and actionable insights into investment, expenses, retirement planning, taxes, and credit management. The website is in a league of its own, featuring state-of-the-art notifications, personalized savings suggestions, bill reminders, budget alerts, and anomaly detection of your financial portfolio.

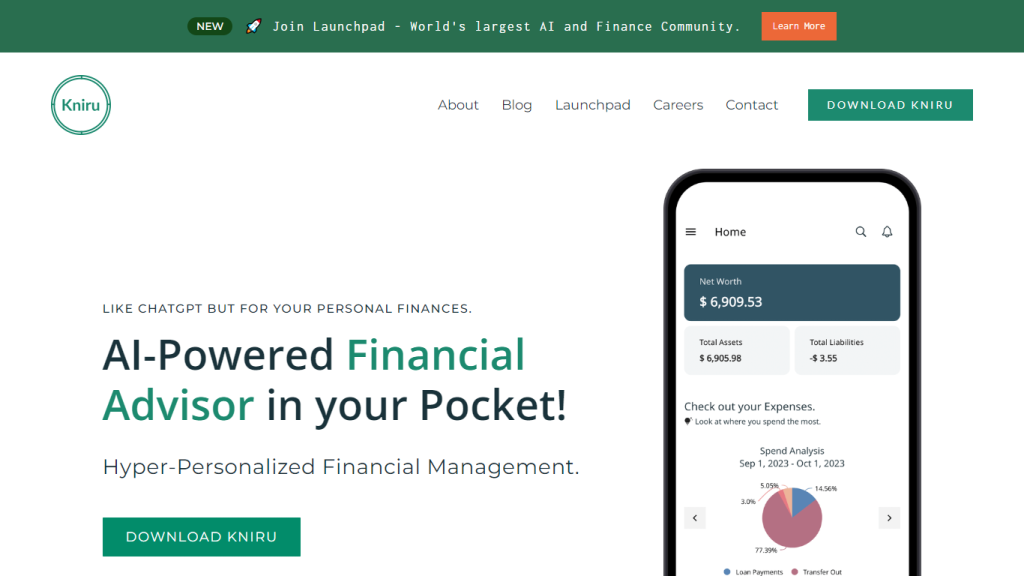

It seamlessly connects a number of accounts worldwide and provides unparalleled visibility into assets, liabilities, and insights through comprehensive dashboards covering bank accounts, investments, real estate, loans, credit cards, spend analysis, and subscriptions.

Key Features & Benefits of Kniru

- Hyper-personalized financial management

- Actionable insights-precise

- State-of-the-art notifications

- Seamless connections to multiple accounts globally

- Anomaly detection on your portfolio

By leveraging those features, Kniru gives power back to users through informed decisions, optimized financial health, and secured financial futures. For the value proposition, the platform offers hyper-personalization and vast global account coverage, unparalleled by most financial management tools.

Kniru Use Cases And Applications

Kniru produces tailored investment recommendations that best fit the financial objectives of the clients, their risk tolerance, and market trends to achieve maximum portfolio returns. It helps users stay ahead with expenses and budgets through proactive bill reminders, personalized savings suggestions, and budget alerts-assuring financial health and stability.

Also, Kniru underlines features of anomaly detection in financial portfolios, such as fraud transactions or unexpected expenses, for quick action and protection of assets. It will be helpful in handling individual investors, people who manage expenses, plan their retirement, or need to keep an eye on taxes and seek credit management support.

How to use Kniru

- Download the Kniru app from the website or app store.

- Create an account and securely link your financial accounts.

- Dive into the comprehensive dashboards to have a fuller view of your financial situation.

- Create custom notifications about reminders for bills, alerts regarding the budget, and updates on your portfolio.

- Engage with Kniru Chat Beta and get instant advice on all things finance.

- Join Launchpad, communicate with others using this community, and learn even more.

It is best practice to review financial dashboards on a regular basis and act on any alerts or suggestions that Kniru may present. By using the community aspects of the service, users are able to keep pace with current strategies in personal finance and trends.

How Kniru Works

Kniru uses the latest AI technology to advise and manage your finances. The platform analyzes your financial data through algorithms that make suggestions and recommendations based on your specific needs. It consolidates many different accounts from around the world and allows one to genuinely view their financial situation holistically through intuitive control dashboards.

Constant financial activity and the detection of anomaly conditions in real-time and proactively will notify and help the users to maintain their financials efficiently. In addition, the AI models of Kniru are designed to automatically adapt changing financial conditions so that advice is kept relevant and actionable.

Pros and Cons of Kniru

Pros

- Detailed finance management with personalized insights

- Seamless integration with any account globally

- Realtime notifications and alerts

- Advanced level of anomaly detection for high-level security ends

Cons or Limitations

- Still in Beta, some functionalities may be under development

- Global account integration might not cover all regions right from the start

Overall reception by users has been very positive. Many praise intuitiveness with regard to the platform’s interface and actionable nature related to insights provided.

Conclusion about Kniru

Kniru: AI-Powered Finance represents a state-of-the-art financial management solution, which-through higher-order AI processes-embeds personalized finance management into seamless global account integration. Due to the peculiar set of features and benefits provided, it is highly suitable for end-users in need of complete consultation about finance. Indeed, with time passing, Kniru will be further developed to bring a complete evolution in the way one handles personal finances. Further updates in the application will make it an even more powerful personal assistant.

Kniru FAQs

What kind of recommendations does Kniru make?

Kniru supplies information on managing wealth, planning retirement, consultancy on taxes, and tracking of expenses, all provided through AI.

Does Kniru have a chat feature that a user can converse about his or her finances with?

Yes, Kniru Chat (Beta) gives advice to users on users’ particular finances through chat.

Is there a community behind Kniru?

Yes, via the Launchpad, Kniru invites users to join what they term the largest AI and Finance Community in the world.

In what regions does Kniru support connecting to financial accounts?

Already, Kniru can auto-link with financial accounts in the United States, Canada, and very soon plans to expand the option to include India and the UK.

What kind of financial dashboards does Kniru offer?

Kniru offers the following dashboards: assets-bank account, investments, real estate; liabilities-loans, credit cards; insights into spending and subscriptions.