What is FlowCog?

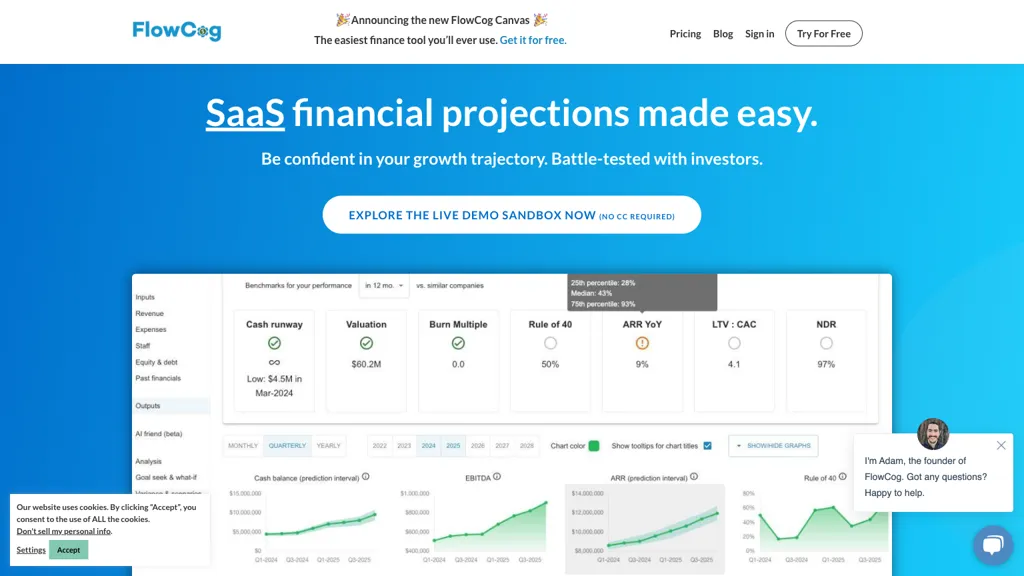

Flowcog is a SaaS financial modeling tool for high-growth SaaS companies. It gives an intuitive canvas—Flowcog Canvas—to map out financial projections which inform strategic decisions, and makes that effort credible towards their investors. Flowcog gets users modeling fast with simple onboarding and AI-powered inputs to generate the important metrics of business, scenario analysis, and budget vs. actual.

It provides connections to widely adopted accounting and payment processing tools, like QuickBooks and Stripe. The platform allows for the visualization of financial statements, simulation analysis, SaaS-specific metrics, and other data through a dashboard that hosts all this information. Flowcog is building financial models for SaaS companies, which is completely missing in today’s other modelling applications. Built-in logic and smart default inputs tailor projection accordingly for the size of the client.

- AI-driven inputs: It makes modeling super easy.

- Integration support: Integrations with QuickBooks and Stripe work perfectly.

- Full stack financial statements: The detail in the insights is an all-time high.

- SaaS metrics: Tailored metrics for SaaS companies.

- Simulation analysis: Scenario planning and decision-making analysis.

- Data visualization dashboards: Beautiful and insightful visualizations.

These functionalities enable high-growth SaaS companies to make financial projections, undertake scenario analyses, and draw financial statements in great detail, extremely fast, and efficiently. Simple in usage and AI-powered input, it consequently allows the users more time to focus on strategic decisions and monitoring of performance.

FlowCog Use Cases and Applications

Flowcog is most useful in creating high-growth SaaS companies’ detailed and accurate financial projections. Its AI-driven inputs and its user-friendly Canvas interface make it possible to produce such projections with low effort, which underpins strategic decision-making while enriching investor credibility.

Flowcog also performs well in scenario planning and budget versus actuals comparisons. QuickBooks and Stripe integration help Flowcog in ensuring that synchronization of data is proper, hence generating financial statements accurately.

Moreover, Flowcog is the ideal channel for a software-as-a-service company to make thoughtful decisions because it conducts simulation analysis and provides unmatched user-friendly data visualization dashboards. It provides key business metrics and SaaS-specific insights, hence enabling one to carry out effective financial planning and monitoring of the performance.

The general users are financial analysts, financial planners, SaaS business owners, and SaaS business executives. Each of these user groups will appreciate the power that its features and capabilities bring to make financial modeling a breeze and decision-making most efficient.

How to Use FlowCog

Using Flowcog is actually very easy, because the interface was designed interactively and it works with AI-based input. Below is a series of tasks to get started:

- Sign up: Start a free trial now when signing up at the website, Flowcog.

- Onboarding: Get through the app with super-fast onboarding to set up your account.

- Integrate: All QuickBooks and Stripe accounts are hooked together, and all data is just in sync.

- Create Projections: Develop financial projections using AI-driven inputs by the Flowcog Canvas.

- Analyze Scenarios: Perform scenario analysis and look at the comparisons of your budgets and actual performance.

- Visualize Data: Obtain valuable visual reports on data visualization dashboards.

To stay best-practiced, remember to keep your financials up to date. Use the simulation analysis and run multiple financial scenarios. It has an intuitive user interface; thus, anyone can find their way around it.

How FlowCog Works

Flowcog operates on top of advanced algorithms and AI-driven models. Pre-built logic, tailored for SaaS companies, enables the tool to have accurate and relevant financial projections. With integration capabilities in place with QuickBooks and Stripe, FlowCogs synchronizes financial data seamlessly using the provider’s live support, offering very accurate financial statements in real time.

Work flow is basically setup of your account, integration of necessary tools, use of the Flowcog Canvas for generating projections. The AI-driven inputs ease this task, and simulation analysis gives users the ability to experiment with many financial scenarios.

Pros of FlowCog

- Easy-to-use interface with AI-driven inputs.

- Integration into QuickBooks and Stripe is seamless.

- Rich detail in financial statement and SaaS metrics.

- Good scenario analysis and simulation capabilities.

- Good-look, insight-rich data visualization dashboards.

Cons

- Exclusively designed for SaaS companies, its use is limited to these kinds of business models.

- Charging may be high for startups or smaller SaaS companies.

There are mostly positive remarks from users, with most of them appreciating it for being easy to use with great functionalities and adding value to financial planning in entirety.

FlowCog Cost

Flowcog provides a free trial, so one can have a glance at features before purchasing a plan. Here’s how the pricing packages are broken down:

- Free Trial: $0

- Enterprise Plan – $149/month

- Special Projects Plan – by quote

- 17% discount on a subscription if subscribed for annually

Flowcog offers great pricing in the market for a specialized platform, compared to other competitors on top of maintaining a strong list of features.

Flowcog is arguably one of the most powerful financial modeling tools out there for high-growth SaaS companies. It is easy to use and includes AI-driven inputs with effortless integration—a product highly valuable for financial analysts, planners, and owners of SaaS businesses. Detailed features of the tool include comprehensive financial statements and SaaS metrics and simulation analysis useful for obtaining insight into strategic decision-making and effective performance monitoring.

While, of course, the tool is made for SaaS companies, which somehow reduces the applicability of other business models, the pros outweigh that small con. Competitive pricing and positive user feedback make Flowcog be rated among the leading choices for SaaS financial modeling.

In the nearest future, with further development and updates, Flowcog is going to turn an even more essential tool for SaaS companies.

FlowCog FAQs

- Q: Does Flowcog have a free trial?

- A: Yes, it allows a free trial period for users to check the product features prior to enrollment for a paid plan.

- Q: Can Flowcog integrate with other financing tools?

- A: Yes, it can. Flowcog can integrate with QuickBooks and Stripe to facilitate easy data sync.

- Q: Who can use the Flowcog tool?

- A: The target customers of this tool are financial analysts, financial planners, business owners, and business executives of SaaS companies.

- Q: From an explanation in your previous answer, it’s already clear that there’s a disparity between Flowcog and other financial modeling software. What do you believe that is?

- A: Flowcog has highly specific projections on the one hand, with all the power of AI-driven inputs, to deliver an individual set of metrics, by your specific SaaS needs, on the other.

- Q: What are the shortcomings of using Flowcog?

- A: However, such broad privileges narrow its scope to exclusively SaaS companies; other business models, hence, are excluded. Besides, it may be priced unaffordably high for start-ups or smaller SaaS companies.