What is FinCheck by Trezy?

FinCheck by Trezy represents the leading edge AI scanning tool for the financial health of any business. This tool enables users to upload their annual reports in return, which provides elaborated and detailed analysis of the key financial metrics with company valuation. It ensures privacy by allowing reports to be shown to the user alone, unless shared by the user.

Developed by TrezyGo, FinCheck has so far been designed to support industries and business types including restaurants, hotels, agencies, e-commerce sites, and retail stores. Being user-friendly, it is available in multiple languages for use by many.

FinCheck by Trezy: Key Features & Benefits

-

Assessment of Financial Health:

Check where your company stands regarding its finances, as indicated by a thorough AI-driven assessment. -

Annual Statement Analysis:

It will generate a comprehensive report on all your key financial parameters from the uploaded financial statements. -

Multilingual Reports:

The report will be available in English, French, or Dutch. -

Privacy Control:

Your reports are kept private until you decide to share them with somebody. -

Security Features:

Security in place for uploaded documents; all reports will be deleted once a user so desires. -

User-Friendly Interface:

One can move quite easily within the platform with the easy upload of documents. -

Free Service:

FinCheck offers a free analysis service to various business types. These range from using FinCheck by Trezy for objective and accurate financial assessments, supercharging decision-making, improving data confidentiality, and opening to the wider market due to multilingual support.

Use Cases and Applications of FinCheck by Trezy

Trezy’s FinCheck allows the upload of annual statements and provides a detailed breakdown of the financial health of the company. It is an AI tool to ensure that correct decisions are taken with regard to key financial metrics.

The reports are multilingual for any international transactions in business. It makes communication and understanding of the financial assessment easy across regions.

Security and privacy:

FinCheck makes it easier to share financial health reports of insurance candidates on a need-to-know basis. Any report could at any time be destroyed, which puts users in a better peace of mind.

FinCheck is used by financial analysts, business owners, and investors who use the financial health report breakdowns and easy interface.

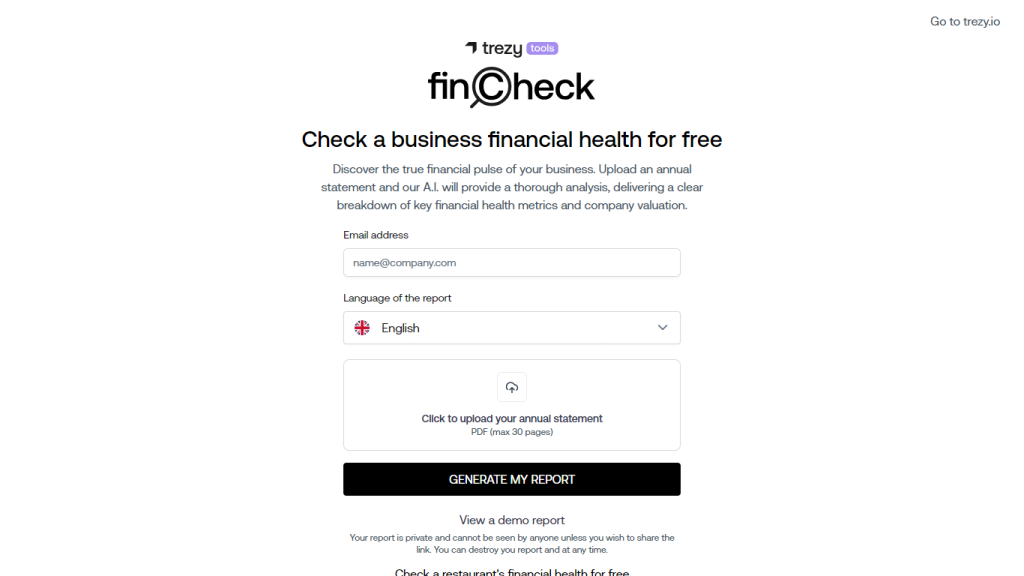

How to Use FinCheck by Trezy

- Log in to FinCheck, trezy.io.

- Upload your annual financial statement(s) in PDF format – limited to 30 pages per file.

- Language for your report: EN, FR, NL

- See an in-depth analysis of your financial health and key metrics

- Optionally share the report or delete it for added security.

In case you want the best results, make sure your financial statement is complete and updated before uploading it. Through its clear user interface, you can navigate easily in this platform and have your reports without much hustle.

How FinCheck by Trezy Works

Trezy’s FinCheck makes use of complex AI algorithms in processing uploaded annual financial reports. The tool is, therefore, in a position to analyze important financial indicators: revenues, expenses, profit margins, company valuation, among many others.

Workflow is the following: upload financial documents, indicate the language in which the user prefers the report to be, and receive a detailed analysis. The AI engine provides accurate and confidential assessment—crucial insights into the financial health of the business.

FinCheck by Trezy Pros and Cons

Pros:

- The main and strongest feature of the product is that it performs precise and professional financial analysis.

- It also offers the ability to generate reports in multiple languages.

- The service will be free for any business kind.

- Strong data privacy and security are maintained.

- Ease of use of the platform.

Possible disadvantages:

- Only allows uploading financial reports in one format: PDF.

- A maximum limit of 30 pages could be insufficient for large companies.

- Overall good accuracy and usability, but with a few suggestions, it raises the diversity of documents supported by the tool and increases the page limit.

Conclusion by Trezy: FinCheck

This, in simpler words, has meant that FinCheck by Trezy is a time-saving, user-friendly AI tool for financial health assessment for businesses. Multilingual reports, privacy control, and free service are just a few features which make it very attractive to business owners, financial analysts, and investors.

Although there are certain limitations in the document format and page limits within the document, FinCheck is very helpful and recommended for financial assessments in general.

The future developments would lie in expanding the types of documents supported, enhancing the analysis capabilities further, and continuing to entrench FinCheck’s position as a leading solution for financial health assessment.

FinCheck by Trezy FAQs

What is FinCheck by Trezy?

FinCheck by Trezy is a tool that offers you an all-round view of how your business is performing with the help of artificial intelligence processing on annual financial reports.

What is the cost of FinCheck by Trezy?

Sure, you can get your free financial health check using FinCheck by Trezy.

Are the reports public?

No, your report is completely confidential and only visible to you unless you share it.

Can I get the FinCheck report in multiple languages?

Yes, this can be either in English, French, or Dutch.

What format and what page limit should I adhere to when uploading financial reports to FinCheck?

You can upload your securely annual financial reports in a PDF format with a maximum of 30 pages.