What is finbots.ai?

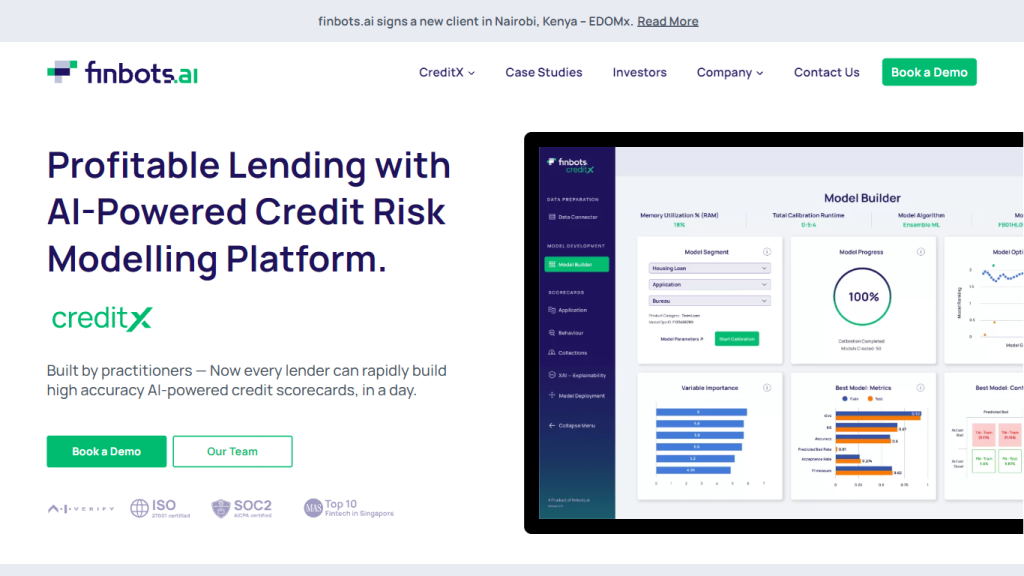

Finbots.ai is an ultra-modern AI credit risk platform with a commitment to deliver the best-in-class AI-driven credit risk management solution. The flag-bearer product, CreditX, is customised by keeping all requirements of the lenders in mind who always want to remain ahead by bringing more accuracy and operation efficiency into their functions. It is known for creating custom scorecards, deploying them very quickly, and intelligent lending.

Powered by robust AI and machine learning algorithms, CreditX is ahead of the curve in enabling financial institutions worldwide to drastically increase their approval rates and, thereby, mostly eliminate their loss rates. It’s known for providing instant decisions, at a very low cost of operation, with seamless integration with data sources of all kinds.

finbots.ai — Key Features & Benefits

Higher Approval Rates: By 20% and more, CreditX ensures more approval rates, making it easy to approve more applicants with confidence. Drop in the expected loss rates of over 15%, thereby bringing down the financial risk. The platform can make well-thought-out credit decisions in less than a second, thereby fastening the pace of lending.

Reduced Operating Costs: The operating costs of financial institutions are reduced by over 50%, hence making it very economical for them.

Trusted Partnerships: CreditX is used globally by leading financial entities and ensures reliability and credibility at all levels.

All these factors together make financial institutions have a truly transformational experience in making credit processes efficient, fair, transparent, and explainable.

Use cases and applications of finbots.ai

The CreditX platform from Finbots.ai finds elaborate application across many sectors and industries. A few recent examples:

-

Lending:

Custom scorecards can be deployed rapidly to help establish retail loan application evaluations for better decision accuracy. -

SME Lending:

With this, even the Small and Medium Enterprises get rapid, correct credit evaluations and, therefore, better access to capital. -

Personal Loans and Credit Cards:

The platform supports diversified financial products; hence there will always be a variant available to support lending.

Some of the major customers using CreditX are EDOMx in Nairobi, Sathapana Bank in Cambodia, and Baiduri Bank, affirming its global mileage and efficiency.

How to Use finbots.ai

The following are the steps that sketch how one can put finbots.ai CreditX into effective use:

-

Integrate Data Sources:

Pool in CreditX the internal, external and alternate data sources in CreditX for data from all conceivable sources. -

Deploy Scorecards:

One-click deployment of credit scorecards across a myriad of lending products. -

Analyze and Decide:

Process data through the AI/ML algorithms on the platform to get analyzed and make instant credit decisions. -

Track and Optimize:

Consider performance metrics at a particular interval in time, leading to scorecard re-evaluation for continued accuracy.

Best practices include the need for regular updates to sources of data and continuous refinement of scorecards based on performance insights.

How Finbots.Ai Works

The finbots.ai CreditX Platform is developed over cutting-edge AI and machine learning algorithms. These developed sets of algorithms enable the creation of very accurate and highly tailored credit scorecards.

Integrate disparate data sources, deploy bespoke scorecards, and operationalize AI/ML models for creditworthiness assessment in a seamlessly integrated workflow. The innate designed process is rapid, transparent, and explainable, thereby ensuring fairness in lending practices.

Pros and Cons of finbots.ai

Pros

- Marked improvement in the approval rate and reduction in loss.

- Real-time decisioning abilities.

- High operational cost-savings.

- Deployed and relied on by most of the leading financial institutions in the world.

Cons

- May require significant set-up and integration.

- Performance must always be monitored and optimized.

finbots.ai Review Conclusion

From the reviews of most clients who have previously used the platform, they have all been positive and have a lot to talk about in terms of efficiency and precision of the system.

Conclusion on finbots.ai

In the end, CreditX allows the development of a sustainable, high-performance credit risk management system. Its advanced features and their benefits make life very satisfying for any financial institution that looks toward enriching its lending process. Constant development and updates from finbots.ai are landing them in the top category in AI-driven credit risk management.

Explore More: FAQs Section

-

Which data can be combined within finbots.ai’s CreditX?

CreditX is capable of combining internal, external, and alternate data. -

How is the credit scorecard deployed in finbots.ai’s CreditX?

CreditX by finbots.ai offers single-click deployment of custom scoring to be used in use cases of retail and SME lending. -

Does finbots.ai’s CreditX use AI/ML algorithms for credit scoring?

Yes, the CreditX solution by finbots.ai uses the most robust AI/ML algorithms for high accuracy and more approvals with less risk. -

Was CreditX promised to the finbots.ai because of its AI governance?

AI Verify was the launch of an AI Governance Testing Framework by the Singapore Government. -

Who are some of the clients of finbots.ai who trust their CreditX?

EDOMx, Sathapana Bank in Cambodia, and Baiduri Bank.