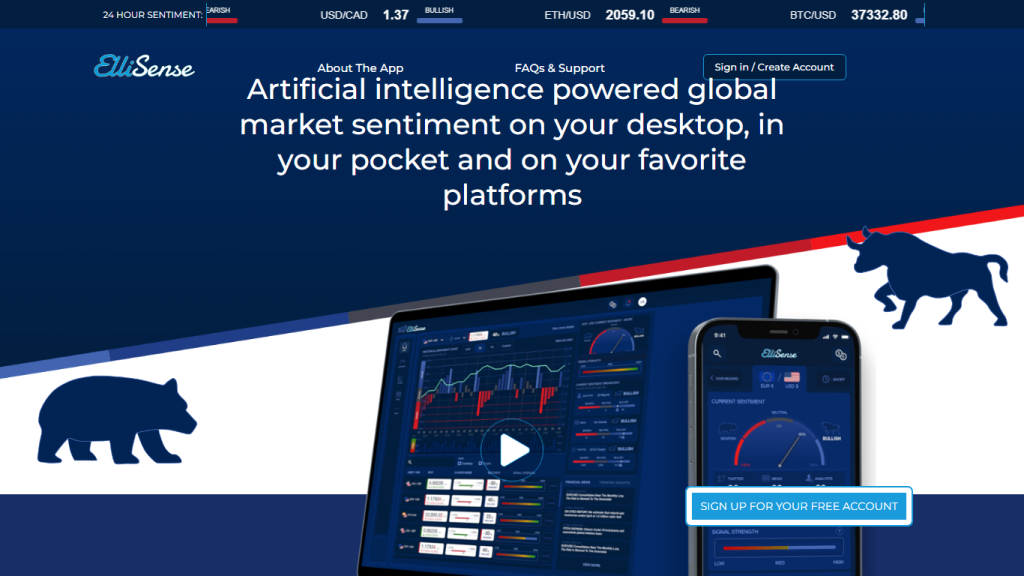

What is Ellisense?

Ellisense is a next-generation AI-based tool that analyzes market sentiment by providing real-time sentiment for various assets such as currency, cryptocurrency, and stock. It scans through thousands of data from these sources, including social media sites and news websites, and gives relevant market insights. Apart from that, it gives advanced charting and historical sentiment analysis to further enlighten the user about market trends. Then, with its accuracy, Ellisense has been partnering with many leading financial institutions and exchange platforms. A free trial period and 24/7 email support further enhance its appeal.

Key Features & Benefits of Ellisense

In the investment domain, Ellisense stands out with its enormous range of features and benefits extending their services to many users. It performs in-depth sentiment analysis on various assets. Its real-time sentiment feature ensures that all updates on market trends are passed on to the user in a timely fashion. Deep market insights are achieved through data analysis from multiple sources. Detailed data visualization is facilitated through advanced charting tools.

Historic Sentiment Spotting: This feature lets users track and analyze data on sentiment for historic series to help them make better predictions about the market. Some of the unique selling points that set Ellisense apart are the robust Sentiment Analysis tool and its partnering with top-tier financial institutions who ensure accuracy and reliability. Advanced charting capabilities provide real-time updates, which convey useful advantages to users seeking to make informed decisions in finance.

Use Cases and Applications of Ellisense

Ellisense can be used for a multitude of purposes, which no doubt renders it one of the most versatile tools across industries. The following are some uses of the tool:

- Sentiment tracking for currency, crypto, and stocks to help make investment decisions.

- Historic sentiment analytics to perceive and learn about market trends in order to predict future movements.

- Partner with financial institutions to achieve accurate sentiment analysis.

Industries that can utilize Ellisense include finance, investment, and market research. Users are mainly financial analysts, investors, traders, and marketing researchers who will be leveraging the powerful sentiment analysis feature in Ellisense.

How to Use Ellisense

Follow these steps to help you use Ellisense. It’s pretty easy to use:

- Sign up: Register yourself on the platform of Ellisense. You can use the free trial period offered by them for knowing more about the features.

- Asset Selection: You can select the desired assets to be analyzed, such as currency, cryptocurrency, or stocks.

- Real-Time Sentiment Analysis: This provides real-time sentiment analysis for the chosen assets.

- Advanced Charting: Advanced charting allows you to better visualize your data and trends.

- Historical Sentiment: You have access to historical sentiment data for analyzing the trends that occurred at any time in the past markets.

Real-time sentiment updates should, for the best practice, be tracked regularly and combined with historical data to provide a unified view of market analytics. The simplicity of the UI will be a forerunner to easy navigation and usage of the tool.

How Ellisense Works

Ellisense utilizes advanced AI algorithms and machine learning models to carry out sentiment analysis. This tool aggregates data from sources like social media and news outlets, analyzes market sentiment with a high degree of accuracy, and performs its workflow in data collection, processing, sentiment scoring, and visualization using advanced charting tools.

The underlying technology makes the sentiment analysis both real-time and historically accurate. It, therefore, avails reliable insights to inform any financial decision.

Pros and Cons of Ellisense

As with any tool, Ellisense has its pros and cons:

Pros:

- It provides real-time and historical sentiment analysis.

- Top-rated financial institutions collaborate for accurate data.

- Advanced charting tools for full data visualization are available.

- There is a free trial period; email support is available 24/7.

Cons:

- It may have a learning curve, which could prove difficult for some new users.

- The tool is only as good as the external data sources it relies on.

Generally, users provide very positive feedback, stating that the tool works well in delivering market information for which one can act. Most users, however, pointed out that the interface can be a little complex at first.

Conclusion about Ellisense

One such AI-driven, powerful tool for market sentiment analysis is Ellisense, which offers real-time and historical insights that would be crucial for a financial analyst, investor, and market researcher. Leading financial institutions are tied up with sophisticated charting tools, thus assuring users about the accuracy and reliability of this tool. After all, it may not be easy to use, but its benefits far outweigh the probable drawbacks. With new developments and updates happening continuously, the position of Ellisense will be at the top for market sentiment analysis in the foreseeable future.

Ellisense FAQs

What is Ellisense?

Ellisense is an AI market sentiment analysis tool that provides real-time and historical sentiment in relation to currencies, cryptocurrencies, and stocks.

How does Ellisense collect data?

Ellisense collects data from social media platforms and news outlets, among other sources, in order to perform sentiment analysis.

Who can use Ellisense?

This tool will, therefore, be very instrumental to financial analysts, investors, traders, and marketing researchers to get the essential market insight.

Is there a free trial?

Yes, Ellisense has a free trial period whereby people use it and see whether they like the product enough to pay for it.

What kind of support does Ellisense offer?

Ellisense offers e-mail support 24*7 to assist users regarding any issue or query.