What is Danelfin?

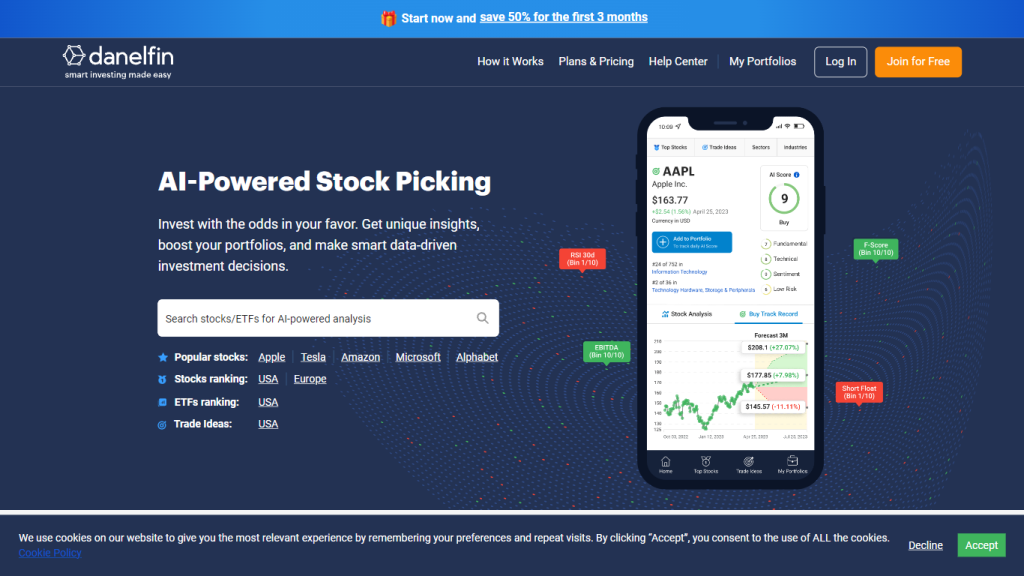

Danelfin is a technically sophisticated, AI-powered tool in the stock-picking and portfolio optimization space. It outfits users with new levels of independence and uniquely differentiated insights, enabling them to make very informed data-driven investment decisions. Historically, this kind of AI technology has been exclusively used by hedge funds and elite investors, but Danelfin democratizes access and opens it up to all.

Danelfin: Key Features & Benefits

Danelfin is one of the ways through which the needs of different types of investors are catered for. Such includes:

-

AI Score:

This is measured on a 1-10 range, showing the chances that one stock will outperform the market over the next three months with a win rate of up to 94%. -

Stock and ETF Analysis:

It analyzes stocks and ETFs across more than 10,000 features from over 900 technical, fundamental, and sentiment indicators. -

Portfolio Optimization:

Danelfin recommends optimal allocation strategies that will ensure proper diversification for your set of investments based on your risk tolerance, goals in investing, and time horizons so that you harvest the best possible returns from your investments. -

Performance Metrics:

This functionality enables the user to view all appropriate performance metrics, such as earnings per share, P/E ratios, and dividend yields, in great detail, supporting the investment decision at hand. -

Personalized Recommendations:

The tool will result in personalized recommendations that are predetermined by the preference of the user and his or her investment strategies, further refining insights over time. -

User-friendly Interface:

It has intuitive visualizations, charts, and graphs that make it quite easy for a user to understand market dynamics and performance metrics. -

Real-Time Updates:

Utilization of the platform by the investor sees to the real-time changes in trends and news affecting the prices of stocks. -

Design:

With such features, Danelfin enables the investors to move through the somewhat volatile world of stock markets with confidence—be this individual investors or professional portfolio managers.

Danelfin Use Cases and Applications

Danelfin can be used in the following use cases:

-

Deliver Better Returns:

Discover high-growth stocks and beat the market with Danelfin. -

Optimal Timing of Investments:

Investing at a time where profitability is ensured through the assistance of the AI Score. -

Tracking Portfolio Stocks:

The AI Score of your portfolio’s stocks will monitor trends, instead suggesting and allowing users to do all the changes in necessary time.

This becomes crucial in fields like finance, wealth management, and personal investing. Case studies indicated that on average, the stocks selected by Danelfin’s AI managed to surpass the market by +20.08% annually since 2017.

How to Use Danelfin

The process to be followed to use Danelfin is pretty much easy and simple:

-

Register:

Open account with the Danelfin platform. -

Add Preferences:

Put investment goals, risk tolerances, and time horizon. -

Stock Analysis:

The platform gives the user an opportunity to search for view stock and ETF ratings and at the same time expound on some trading ideas. -

Portfolio Optimization:

Use those recommendations developed by AI for portfolio optimization.

Some of those good practices would be checking AI Scores regularly and keeping up to date with real-time market trends provided by the platform. The user interface is so intuitive that navigation through it will not pose any problems at all for both the fresher and the expert alike.

How Danelfin Works

This is so because Danelfin works with state-of-the-art AI algorithms and models that crunch through vast arrays of financial data—from historical stock prices to market trends and company fundamentals. This process includes:

-

Collection of data:

from various sources—financial statements, news, and trends in the markets. -

Analysis of features:

more than 10,000 features get appraised in consideration with help from 900+ indicators in drawing meaningful inferences. -

AI Scoring:

Every stock and ETF is provided an AI Score reflecting the market outperformance potential. -

Recommendation:

Personalized investment recommendations after combining inputs provided by the users and the analysis of AI.

This ensures that insights are provided with robustness, reliability, and fit with the person’s investment strategy.

Pros and Cons of Danelfin

The following are the pros and cons of using Danelfin.

Pros

- Deep stock and ETF analysis.

- High accuracy – up to 94% on the win rate.

- Personalized Recommendations.

- Easy to use with user-friendly graphics and intuitive visualisations.

Cons

- Might present a slight learning curve for beginners.

- Freemium model might limit access to specific premium features.

At large, user reviews would show that this tool is accurate and also easy to use despite some of them saying that an initial learning curve is required.

Conclusion about Danelfin

Danelfin, in a capsule, is a robust AI-enabled stock selection and portfolio optimization platform. Being feature-rich, yet user-friendly and personalized in recommendations, the platform renders immense value to an individual investor or professional. Throughout development and upgrade into newer versions, Danelfin would offer improved value through insights of sophistication, delivering better value to users against any other alternative for financial success.

FAQs Danelfin

-

What is Danelfin?

It is basically a one-stop-shop AI stock picker and portfolio optimizer, providing synergy and concurrence between deep analysis and personal recommendations. -

How accurate is Danelfin?

The AI Score has up to a 94% win rate in helping users seek out high-potential stocks. -

Is Danelfin for beginners?

Easily navigable by new investors, it carries a user-friendly interface with very intuitive visualizations. -

What is the pricing model?

Danelfin operates with a freemium model – basic features are free, while premium features are charged. -

How does Danelfin make personal recommendations?

The tool learns from user interaction and refines its recommendations against personal preference and investment strategy.