What is Basil Finance?

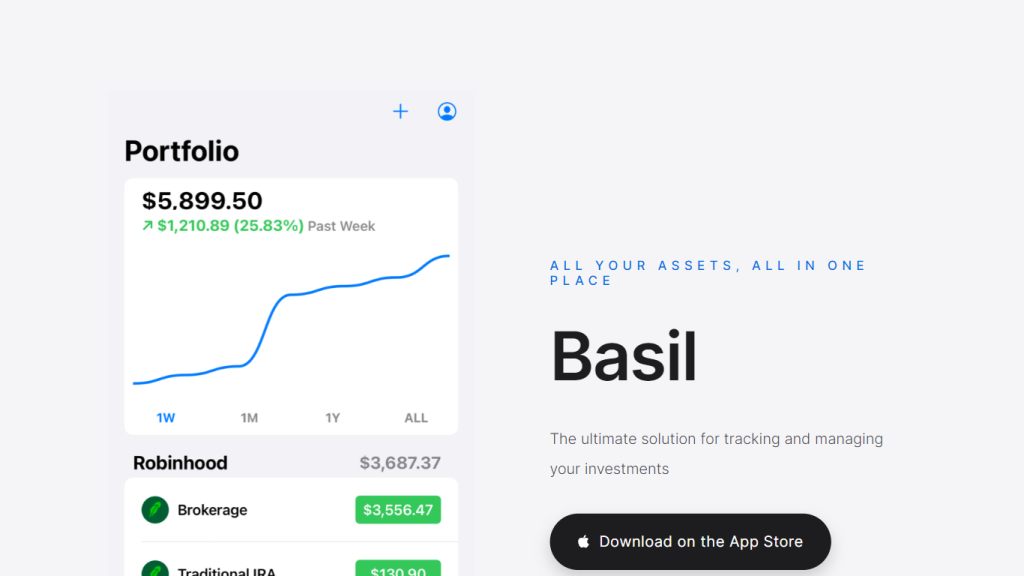

Basil Finance is a one-stop platform that smoothes your investment tracking and management. With Basil, easily link your MetaMask, Trust, Fidelity, Vanguard, and more, and start getting a unified view of all your assets in one place. Born out of frustration from using traditional finance apps that all have a lot of shortcomings, the novelty of its offerings mixed with innovative features makes Basil truly different.

Basil Finance Key Features & Benefits

Basil Finance is an investment management application that empowers your portfolio management with a raft of features that help make sense of it. Some of the key features and benefits of Basil Finance include:

-

Wholistic Asset Management:

Basil Finance links securely all your different accounts in one spot, putting a full overview of your assets at your fingertips. -

Insightful Analytics:

Basil Finance will give you detailed breakdowns on asset allocation or any other meaningful investment insights you may need, so you can closely monitor the performance of your entire portfolio. -

Basil AI Chatbot:

Have dynamic conversations, receive real-time updates on the markets, and get personalized investment ideas to manage your investments with AI-powered insights. -

Comprehensive Research Tools:

Informed users, deep data on thousands of assets for unparalleled insight. -

Best-in-Class Security & Privacy:

Prioritizes user safety through a read-only access system, does not store sensitive information, and anonymizes data stored.

Use Cases and Applications of Basil Finance

Basil Finance is versatile, catering to a wide range of use cases and applications. For example, it could serve the needs of:

-

Individual Investors:

At its very core, Basil Finance is designed to enable individuals to manage and keep track of their diverse investment portfolios—from crypto assets down to traditional retirement funds. -

Financial Advisors:

Basil Finance will help advisors give detailed insights into investments for their clients, further developing recommendations pertinent to their specific needs. -

Institutional Investors:

This will give institutions a better way to track large investments while showing more granular analytics.

Using Basil Finance

Getting started with Basil Finance couldn’t be easier:

-

Sign Up:

Create an account on Basil Finance’s web platform. -

Link Accounts:

Link your various investment accounts, crypto wallets, and retirement funds securely. -

AI Chatbot:

Avail the services of an AI-powered chatbot for real-time market updates, personalized recommendations, and many more. -

Portfolio Analytics:

Dive deep into portfolio analytics in order to keep up with performance and asset allocation.

Tips and Best Practices

Periodically refresh the linked accounts; use the various research tools provided by Basil to stay abreast of market trends.

How Basil Finance Works

Basil Finance has utilized the most advanced AI technology so that every aspect of investment management will flow smoothly and seamlessly. Here are some key features:

-

AI Algorithms:

It has put to use sophisticated algorithms to analyze market data and generate personalized investment recommendations. -

Data Integration:

Safely integrates all account data into one unified view of assets. -

Real-time Updates:

Provides real-time market data and intelligence through an AI-powered chatbot.

Basil Finance Pros and Cons

One may consider many favorable aspects of Basil Finance, and similarly, one should not turn a blind eye to the disadvantages either.

-

Pros:

- Centralized asset management

- In-depth analytics and insights

- AI-powered personalized suggestions

- Very secure and private

-

Cons:

- May require linking too many accounts

- Can be tricky for new users to navigate

Conclusion about Basil Finance

All in all, Basil Finance is a pretty interactive investment management and tracking platform, with AI insights and analytics capabilities. Attention to the security and user experience aspect makes Basil Finance a trusted partner for both individual and institutional investors. And as happens with everything, Basil Finance will keep evolving, which also means the users should also expect certain improvements and updates that would seal the spot of Basil Finance among other investment management solutions.

Basil Finance FAQs

How does AI relate to finance?

AI in finance provides predictive analytics on huge data sets, automates fraud detection, and is used to deliver personalized financial advice and customers’ service through AI-powered chatbots and robo-advisors.

How is AI changing finance?

This AI is remodeling the finance industry by accurately offering predictive analytics, risk analysis, and automation of tasks of a higher level of difficulty, thus changing customer interaction and decisions on investment.