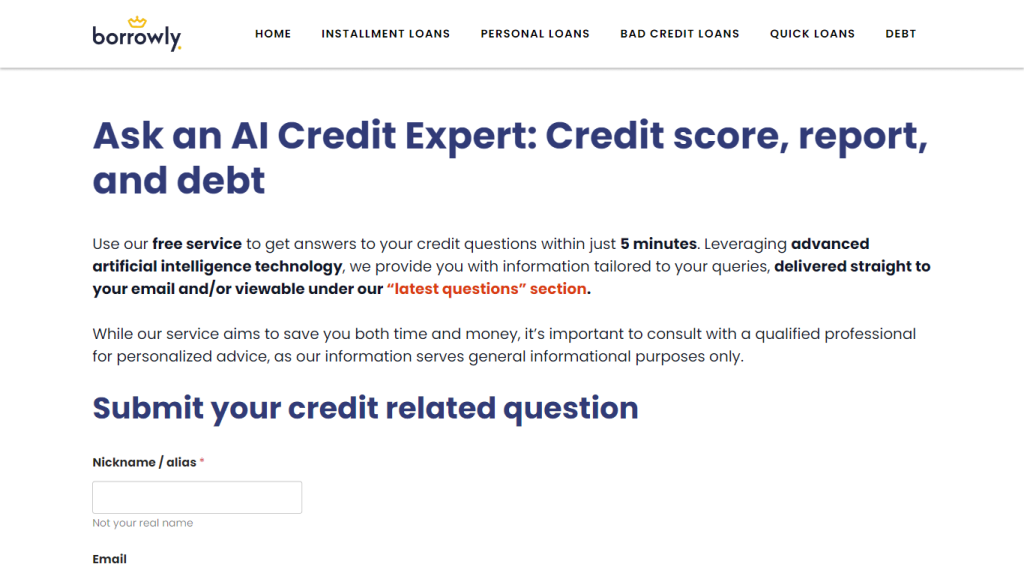

What is Borrowly’s Ask an AI Credit Expert?

Borrowly’s Ask an AI Credit Expert is a complimentary service designed to offer general advice on a wide array of credit-related matters. By leveraging cutting-edge artificial intelligence algorithms, the platform is capable of generating answers to specific credit inquiries within a five-minute timeframe. These responses are sent directly to the user’s email and can also be viewed in the “latest questions” section on the website.

Borrowly’s Ask an AI Credit Expert’s Key Features & Benefits

- Specially Crafted Prompts: The service employs customized prompts to gather precise details for credit-related questions, thereby enhancing the relevance and accuracy of the advice provided.

- Clear Presentation: Unlike conventional chatbots, Borrowly’s platform prioritizes delivering responses in a clear and easily understandable format, aiming to help users grasp complex credit topics more effectively.

- No Sign-Up Required: The service is free and accessible without the need for account creation or sign-up, offering quick and hassle-free consultations on various credit issues.

- 24/7 Availability: The AI service is accessible around the clock, unlike human advisors who typically operate during business hours.

Borrowly’s Ask an AI Credit Expert’s Use Cases and Applications

This AI service can be utilized in numerous scenarios, including:

- Credit Score Queries: If you’ve noticed a sudden drop in your credit score and are unsure of the reasons, the AI Credit Expert can provide insights into possible factors like late payments or high credit utilization rates.

- Debt Management Strategies: Receive advice on how to manage and reduce your debt, a critical aspect of maintaining a healthy credit profile.

- Credit Report Errors: The service can guide you through the recommended steps to correct inaccuracies in your credit report, an essential task given that one in five consumers has an error on at least one of their three credit reports.

- Loan Eligibility: Understand the factors that affect your eligibility for various loans, helping you make more informed financial decisions.

- Identity Theft: Learn how to safeguard your credit profile against identity theft and take necessary actions if you suspect fraudulent activity.

How to Use Borrowly’s Ask an AI Credit Expert

Using this AI service is straightforward:

- Visit Borrowly’s Ask an AI Credit Expert website.

- Type your credit-related question into the provided prompt.

- Submit your question and wait for the AI to process your query, which typically takes around five minutes.

- Check your email for the response, or visit the “latest questions” section to view the answer.

Tips and Best Practices:

- Be specific in your questions to get the most accurate and relevant advice.

- Regularly check the “latest questions” section for additional insights.

How Borrowly’s Ask an AI Credit Expert Works

Borrowly’s Ask an AI Credit Expert employs advanced artificial intelligence algorithms to generate accurate answers to credit-related inquiries. The process involves specially crafted prompts that extract precise information from users, which the AI then analyzes to provide well-informed advice. This ensures that users receive responses that are both relevant and easy to understand.

Borrowly’s Ask an AI Credit Expert Pros and Cons

Advantages:

- Free and accessible without sign-up.

- Clear and easy-to-understand presentation format.

- 24/7 availability, unlike traditional human advisors.

Potential Drawbacks:

- The service provides general advice and may not be suitable for complex or legal issues, for which a qualified professional should be consulted.

- As an AI-driven platform, it may lack the nuanced understanding that a human advisor could provide.

User Feedback:

Overall, users have found the service to be highly beneficial for quick and general advice, particularly appreciating its accessibility and clarity.

Borrowly’s Ask an AI Credit Expert Pricing

The standout feature of Borrowly’s Ask an AI Credit Expert is its cost-effectiveness: it is entirely free. In contrast to traditional credit repair companies that may charge upwards of $149 per month, this AI-driven platform offers rapid and reliable advice at no cost.

Conclusion about Borrowly’s Ask an AI Credit Expert

Borrowly’s Ask an AI Credit Expert offers a valuable resource for anyone seeking quick and accurate advice on credit-related matters. Its user-friendly design, clear presentation, and 24/7 availability make it an excellent tool for managing credit issues. While it may not replace the need for professional legal advice in complex cases, it serves as a highly effective first step for general inquiries. Future developments and updates are likely to further enhance its capabilities, making it an indispensable tool for credit management.

Borrowly’s Ask an AI Credit Expert FAQs

Can I ask about credit score dips?

Yes, if you’ve experienced a sudden dip in your credit score, this service can provide general insights into the possible factors affecting your score. Common reasons for a drop in credit score include late payments, high credit utilization rates, or the closure of an old account.

Can I ask about credit report errors and how to handle them?

Yes, the AI Credit Expert can guide you through the steps generally recommended to correct these errors, such as contacting the credit bureau or the financial institution that reported the incorrect information.

What is the cost of using Ask an AI Credit Expert?

The service is entirely free, providing rapid and reliable advice at no cost.

What hours is Ask an AI Credit Expert online accessible?

One of the key advantages of this AI service is its around-the-clock availability, unlike human advisors who generally operate during business hours.

Who can use this service?

Ask an AI Credit Expert is designed for universal applicability, whether you’re a college student, a working professional, or someone grappling with debt management. There are no prerequisites for usage, and the information can be viewed by anyone under the “latest questions” section.

“`