What is FinanceGPT?

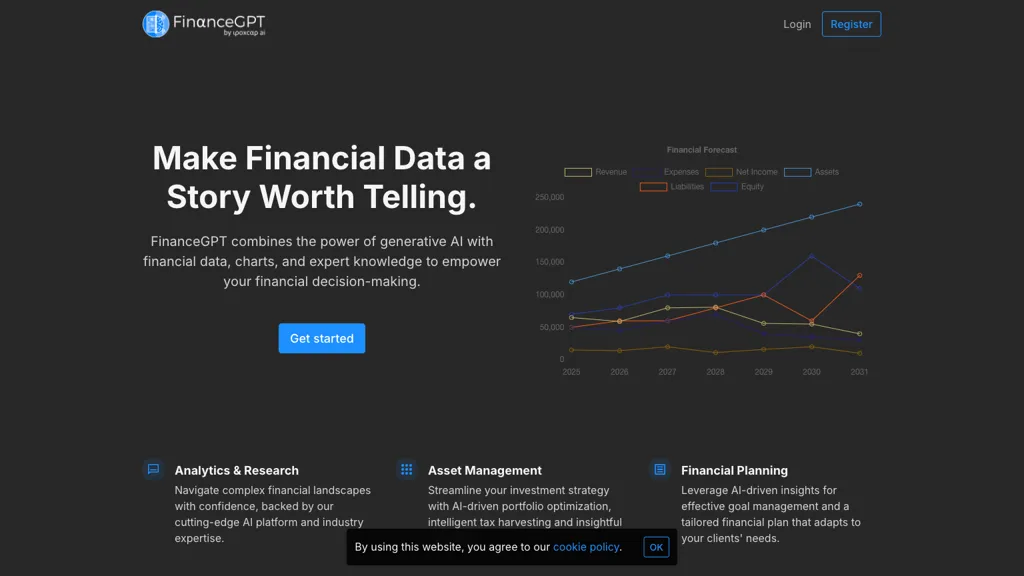

FinanceGPT is an innovative AI-powered solution that transforms complex financial data into informative insights and engaging narratives. The new generation of advanced generative AI in FinanceGPT develops decisions not only faster but better, literally pumping power to the platform through the integration of AI-driven financial analysis. It provides use in asset management to financial planning, and it allows for customizable financial forecasting, real-time data aggregation, and advanced analytics to give developers critical insights into the company’s fiscal performance. Designed for investors, financial managers, and accountants, it allows users to get powerful ways of managing money to make confident, numerated strategic decisions.

Key Features & Benefits of FinanceGPT

FinanceGPT provides a full array of features and benefits that keep it at the top of the list when used by finance professionals. Some of the crucial aspects are:

- Generative AI technology

- Customizable financial forecasting

- Real-time data aggregation

- Advanced analytics

Many are the benefits realized from the application of FinanceGPT. This allows the user to be updated and current with their financial data and projects, organize financial reports, and finish with comprehensive details. Lastly, this will facilitate the identification of possible risks and opportunities, fine-tuning investment decisions, and enhancement of strategies in the management of financial risks.

Use Cases and Applications of FinanceGPT

FinanceGPT is versatile and might be used in the following aspects:

- Prepare detailed financial reports summarizing certain financial metrics and trends for investors and stakeholders.

- Make financial predictions through automation of forecasting, which permits users to make data-based projections and strategic decisions on AI-based insights.

- Improve the financial risk management process with advanced analytics based on potential risks and opportunities while fine-tuning the process of investment in a less risky financial environment.

The stakeholders of the focused areas or sectors of finance, investment, and accounting require dependable information for decision-making purposes.

How to Use FinanceGPT

To use FinanceGPT, one can simply do so by following the steps described below:

- Register with FinanceGPT to get your own account on the platform.

- Integrate your financial data onto the system.

- Configure the system with specified limitations on financial forecasting.

- Provide real-time data aggregation for updated financial information.

- Harness the ability of the latest analytics AI in FinanceGPT, to look at your data.

- Generate in-depth and meaningful intelligence from the analyzed data that will empower you to make better, well-informed decisions.

For best results, replenish the data often, and use the features to customize the analysis to your needs. The user interface is intuitive — easy to work your way through.

How FinanceGPT Works

The algorithms and models integrated into FinanceGPT are designed to accommodate humongous volumes of financial data, all meant to be transformed into very useful insights and stories. First of all, it starts off with the aggregation of data where real-time data is aggregated every time it updates. It is then analyzed by a much more advanced level of analytics capable of unraveling available trends, risks, and opportunities. Finally, it’s presented in a neat and clean structure where users can make decisions based on what’s displayed.

Pros of FinanceGPT

- Helps make better decisions through AI insights

- Saves on time since the tool can help automate the function of financial forecasting and reporting.

- Overall better risk management and identification of opportunities

Cons

- Involvement of a learning curve for users who are not aware of AI technology

- It relies on the input data to be accurate in order to have reliable output

- It might have some extra costs for the premium features.

User feedback generally highlights the tool’s effectiveness in improving financial analysis and decision-making, although some users note the initial complexity in navigating the platform.

Conclusion on Finance GPT

Summarizing, FinanceGPT is an extremely potent AI-based solution that can boost the financial analysis and decision-making process. It offers a lot of invaluable insights to investors, accountants, and financial managers with forecasting that can be personalized and real-time collection and analysis. The application of FinanceGPT, though a little cumbersome in the first sense, apparently outweighs any cons that could crop up, making it a justified investment for potential use in this financial sector. Going forward, the platform effectiveness is continuously updated and improved.

FinanceGPT FAQs

-

What does FinanceGPT do?

It is an AI tool that converts convoluted financial data into actionable insights and compelling narratives, with the latest generative AI technology. -

Who uses FinanceGPT to perform their jobs?

FinanceGPT is most useful to investors, financial managers, and accountants. -

How does FinanceGPT enhance financial forecasting?

The automated financial forecast by FinanceGPT enables the users to project with data-backed forecasting but an AI-fortified outlook. -

Is FinanceGPT easy to use?

Definitely, FinanceGPT is created for maximum human usability. However, an average user naive in an AI tech environment takes time to intermingle with the platform. -

What charges are concerned with FinanceGPT?

FinanceGPT offers different pricing models that work according to the users’ understanding. The website provides all details.

The dependability of the data on FinanceGPT relies on the accuracy of its input data. The best results will finally be yielded by regular updating and accurate inputs.